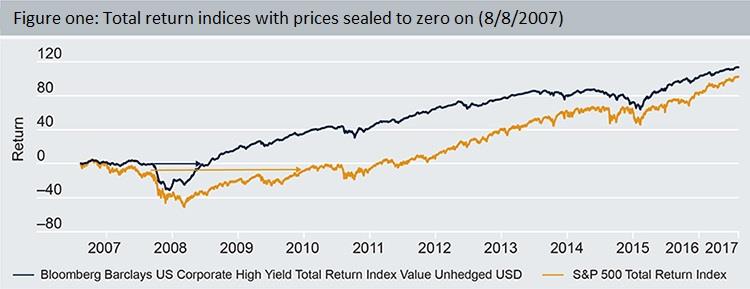

Over this period, it appears that high-yield bonds weathered the crisis much better than equities. Depending on the exact time frame you look at, starting around late 2007, the total return on the S&P 500 only began to surpass the total return of the High-Yield Index, about nine years after markets bottomed in the crisis. Another notable observation is that the total return of the High-Yield index recovered to pre-crisis levels in about 9 months (indicated by the blue arrow in the exhibit below), whereas the total return of the S&P 500 recovered in about 27 months (indicated by the gold arrow below using the same start date for comparison). In other words, it took about three times longer for the equity index to make up for large losses in the financial crisis than for the High-Yield Index to do so. One explanation for this could be that the High-Yield Index’s high level of current income, relative to that of equity indices, greatly magnified the power of reinvesting cash flows at ultra-low prices during the financial crisis.

Source: Bloomberg for the period 8/8/2007 through 8/8/2017. Past performance is no guarantee of future results.

In addition, in the years that followed the crisis, the High-Yield Index not only exhibited higher returns but also exhibited lower volatility than the S&P 500. More details on this observation can be found in one of our previous Xpert Spotlight publications.

Ultimately, investing in high-yield corporate bonds may be an interesting option to consider for a long-term investor seeking to boost current income while gaining a strategic exposure to an asset class that better diversifies a portfolio of equities and lower-yielding bonds. Investors concerned with a future downturn should be relieved to observe how well and how rapidly the High-Yield Index rebounded after the financial crisis (though past performance is no guarantee of future results).

Diversification may not necessarily ensure a profit or protect against a loss.