With the Russell 2000 index up 12%, it’s easy to see why investors are favoring small cap equities. For strategic exposure to small caps, ETF investors can opt for the Invesco RAFI Strategic US Small Company ETF (IUSS).

The month of February provided strong tailwinds for small cap equities, which are relatively sensitive to market movements.

“February was a very interesting month,” said Sinead Colton, deputy chief investment officer and head of equities at BNY Mellon Wealth Management, in an Investor’s Business Daily article. “We’ve seen a trifecta of optimism. We had the vaccine rollout accelerating in major developed countries. We had, what looked like, additional certainty around the $1.9 trillion stimulus package from the Biden administration. And then, we started to see stronger consumer data.”

IUSS seeks to track the investment results of the Invesco Strategic US Small Company Index. It employs a ‘full replication’ methodology in seeking to track the index, meaning that the fund generally invests in all of the securities comprising the index in proportion to their weightings in the index.

The index is designed to measure the performance of equity securities issued by higher quality, small-business-sized companies in the United States. IUSS’s expense ratio is a low 0.23%.

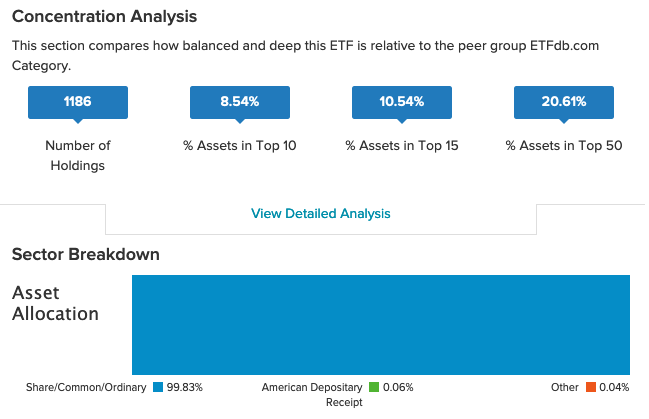

With almost 1,200 holdings in its portfolio, IUSS provides a diverse array of holdings that minimize concentration risk. The top holding, GameStop, only comprises about 3% of the fund’s assets.

Momentum Continues to Rise for IUSS

Meanwhile, IUSS continues to feed off the momentum in the small cap rally.

Since the pandemic, IUSS has been on an absolute tear. The fund is up about 73% within the past 12 months, with momentum clearly on its side.

August 19, 2020 saw the first sign of the ‘golden cross’ appear for IUSS as its 50-day moving average moved up past its 200-day moving average. Since then, IUSS has been on a steady uptrend into 2021.

Confirming its momentum is the relative strength index (RSI), which is firmly in overbought territory at a 70.33 level. With inflation fears rising as Treasury yields tick higher, it’s something investors should watch amid the volatility.

For more news and information, visit the Smart Beta Channel.