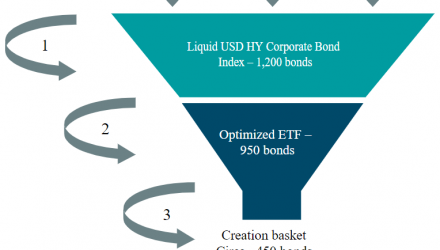

We start off with the overall universe and then dial it down to the most liquid securities in the benchmark. From there, we create an optimized ETF which is a still smaller number of bonds which can replicate the overall performance characteristics of the index at large.

It is important to note that the final step consists of building a good creation basket so that APs can easily participate in the creation and redemption process. In other words, APs may only need to provide a subset of the ETF’s holdings to obtain new shares or redeem old ones, though it will be representative of the whole and generally more easily traded as well. The idea behind this is to promote overall liquidity and to make an AP’s job of gathering and dispersing securities all that much easier, so long as it remains representative of the overall ETF.

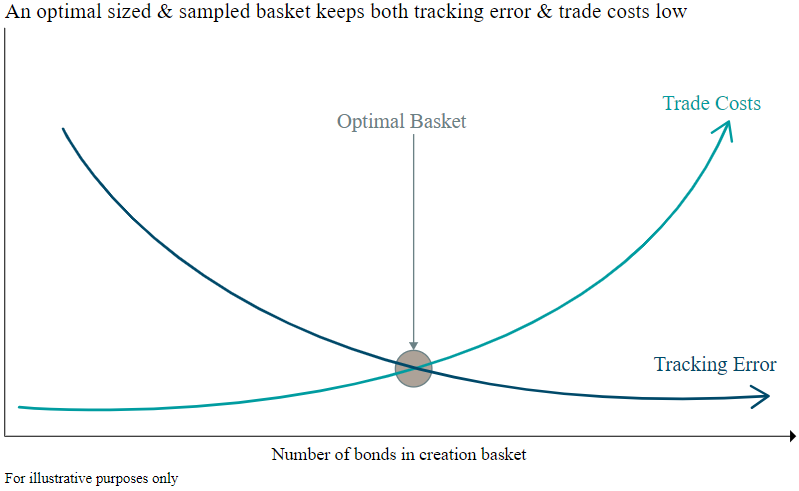

While this might seem like a complicated process, all of this is done to balance two competing and easy to understand factors that play into the construction process: trading costs and tracking error. The closer a portfolio gets to full replication the greater the cost. However, the flipside is generally true: the lower the cost, the greater the tracking error.

The job of the capital markets team is to find the ideal point that balances both of these important items, without sacrificing too much in terms of tracking or costs. This is why many fixed income ETFs utilize a sampling methodology. Without it, full replication would result in far higher costs, while just buying a tiny subset would likely give too high of tracking error. The equilibrium is needed to find the optimal basket for a given investing situation.

Key takeaway

When it comes to ETFs, the creation and redemption mechanism is a key aspect of the process. However, this is only part of the story when it comes to fixed income investing thanks to the massive size of the bond market and its opaqueness.

Here, having a vigilant capital markets group on your side is arguably very important, as you need a team that is going to keep watch for any changes in the market, and will stay committed to keeping both tracking error and trading costs low. This is perhaps the only way to build a lean portfolio that can give investors the type of exposure they are seeking in the world of fixed income, while also taking advantage of the ETF structure.