First let’s review the empirical numbers. The standard deviation of the euro’s weekly returns since inception was 1.37%, which when annualized, becomes around 9.87%. There seem fewer better candidates for that well-known market pun of “return-free risk” than the euro to date.

Correlation

The discussion of risk leads to an absolutely critical, but very subtle, point about the role that currency plays in a portfolio. Since the Correlation of the euro’s weekly returns to the Eurozone stock market (total return of MSCI Eurozone, in local terms) has been -0.01, so effectively zero, an investor might ask this very reasonable question:

“How is it possible to add an uncorrelated asset (the euro) to my Eurozone equities, and have the resulting portfolio be more risky at any point in time?”

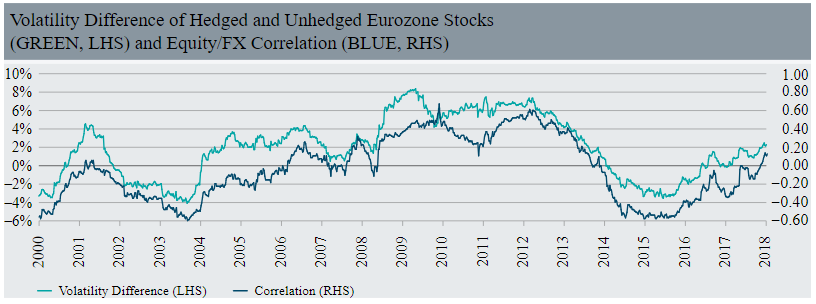

Well, in our view, the answer comes from the implicit leverage that currency brings to a portfolio. This is shown in Figure Four where we have plotted the volatility differences between hedged and unhedged Eurozone stocks, against the rolling correlation numbers. This chart merits some consideration in our view, because, it not only shows that unhedged access has been riskier for a US investor the majority of the time (specifically 70% of rolling periods), but it also shows how important correlation is in driving that risk. Only when correlation was quite negative did the euro help to reduce the risk in the portfolio – zero was not enough!

Hedging Costs

When one sees the potential for volatility reduction that removing the euro has had since inception, the obvious question that will now occur to most investors is – how much does it cost? Since it’s to their advantage (assuming their view on the spot move of the currency is agnostic) then the expectation must be, quite reasonably, that it costs to implement the hedge. In fact, because the main driver of hedging costs are interest rate differentials, and because rates in the US have been higher than those internationally for some time, the surprising answer is that US investors have actually enjoyed a positive cost of carry to implement the hedge (economist speak for getting paid!).

Conclusions

As US investors ponder the 20th birthday present that they might gift to the euro, perhaps they should first reflect on how good of a friend the single currency has been to their portfolios. From the above analysis, it seems some “re-gifting” might be in order!