Despite the word on the street, we’re not in an economic boom. This according to a recent article in The New York Times.

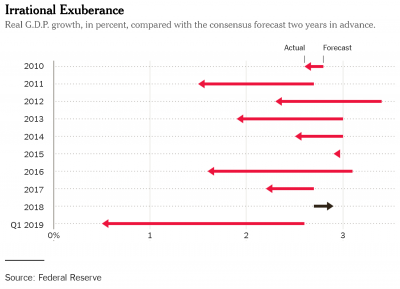

“The economy has been mired in an extended funk since the financial crisis ended in 2010. G.D.P growth still has not reached 3 percent in any year, and 3 percent isn’t a very high bar,” writes columnist David Leonhardt. He offers data showing that the economy keeps performing more poorly than experts have predicted:

Fed officials, the article says, keep having to revise forecasts downward, “only to discover that they didn’t go far enough down. Economists on Wall Street and other parts of the private sector have made the same mistake.”

The problem, Leonhardt writes, was described several years ago by economist and former treasury secretary Lawrence Summers as “secular stagnation”—a term coined during the Great Depression to describe an economy that can’t seem to get healthy. The article outlines two causes:

- Savings glut: Americans are saving more and spending less “partly because the rich now take home so much of the economy’s income.” The aging population also contributes, since people are saving for retirement.

- Investment slump: “Despite all the savings available to be invested,” the article reports, “companies are holding back. Some have grown so large and monopoly-like that they don’t need to invest in new projects to make profits.” This comes from what Summers calls the demassification of the economy—goods now go straight from warehouses to homes, cellphones have replaced desktop computers, cameras, stereos and books, and offices don’t need as much storage space.

Summers cites a list of possible solutions, including:

- Infrastructure projects and the retirement of coal-fired power plants, both of which would jump-start investment;

- Stronger safety-net programs to reduce the savings glut;

- More aggressive antitrust policies to combat corporate monopolies;

- A Fed that stops “overestimating both growth and inflation.”

For more market trends, visit ETF Trends.