![]()

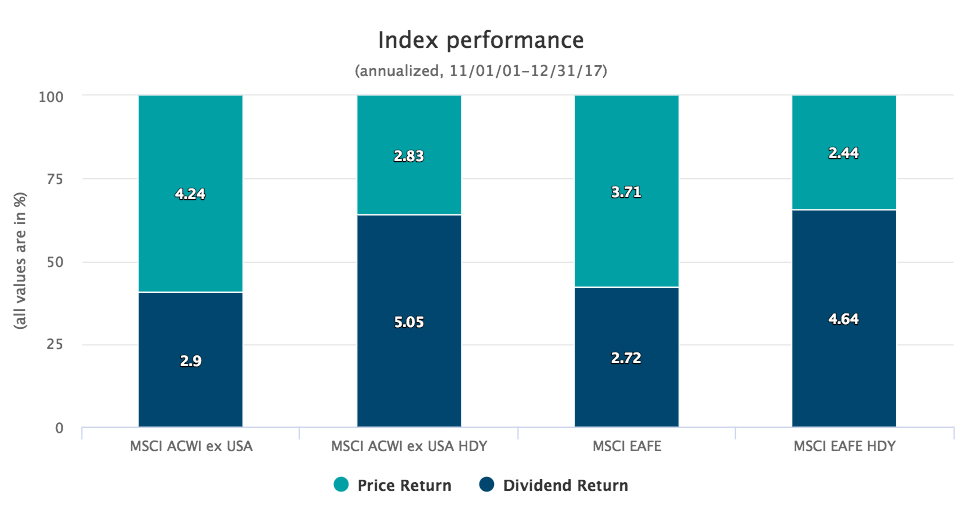

Source: MSCI as of 12/31/17 (latest available). Past performance does not guarantee future results. For illustrative purposes only. HDY denotes high-yield dividend indexes. Cannot invest directly in an index. Dividends are not guaranteed and companies can stop paying dividends without notice.

In other words, while high-yield indexes might not be able to beat their traditional cousins solely from a price return perspective, they have (historically) more than made up for that gap with their outsized yields. This should underscore the importance of dividend investing, especially over long time frames and across global markets.

And while a dividend-focused approach was clearly a historical winner, the chart above also illustrates how important dividends remain for ‘regular’ indexes as well. In both the ACWI ex-USA and the EAFE indexes, dividends account for more than 40% of the returns for the time frame in question, suggesting that dividends are a crucial component in these kinds of indexes too.

Bottom Line

From a price perspective, dividend-focused indexes often have a hard time keeping up with their more traditional peers. But when you consider dividends and the impact that strong yields have on a portfolio over long time frames, it becomes clear that yield-centric investing is still very much competitive with traditional portfolio techniques, if not a more optimal path.

So, while dividends might have lost some of their luster in the recent market environment, the history of dividend-focused portfolios is hard to ignore. Even in a tech-focused market, dividends still matter and may be not only vital contributors to gains, but often times, potentially the difference between outperformance and poor returns.