When considering the various investment approaches, Bryson outlined potential risks investors should consider. For example, with market-cap-weighted passive products, a slow deterioration of performance versus the benchmark is the all but assured due to the effects of fees over time. For multifactor strategies, you can expect a range of performance that includes above- and below-benchmark results, depending on whether the targeted factors are in or out of favor over a given period. For single-factor, you should expect an even wider range of performance results, depending on the fortunes of the single factor chosen. For closet indexers, you might get outperformance but you should basically expect underperformance because of the higher fees and lack of fully active exposures. Lastly, for a traditional active manager, you should expect the widest range of performance, to the upside and downside.

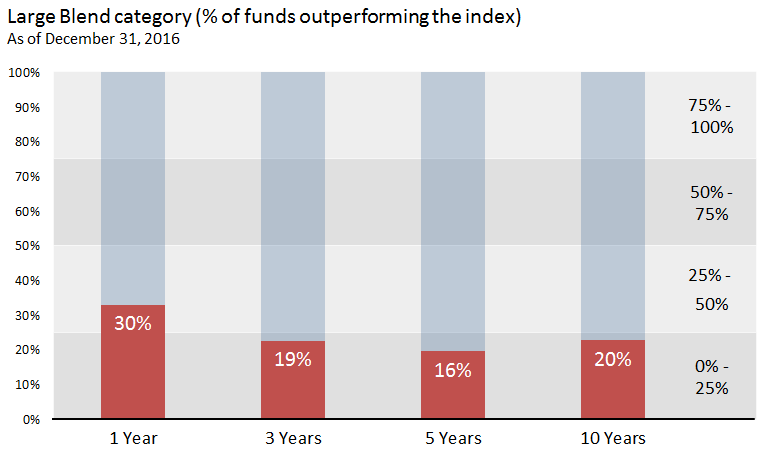

When considering an active manager, investors should be aware that many have not exhibited a good track record as about 20% of active large blend funds outperformed their index over the 10-year period ended 2016. Nevertheless, there are some areas where active managers have shown a greater propensity to outperform, such as foreign small/mid growth, small value and foreign large growth.

Consequently, this leaves a lot of areas open for investors to consider a cheap passive index-based option to gain market exposure. However, potential investors should keep in mind the potential pitfalls of relying on traditional market-cap weighted index funds, which opens up an opportunity for smart beta strategies to potentially help diversify a portfolio and bolster returns.

Among the new breed of investment strategies now available, investors can look to John Hancock’s broad smart-beta ETFs to fill out a core portfolio position. For example, the John Hancock Multifactor Large Cap ETF (NYSEArca: JHML) and John Hancock Multifactor Mid Cap ETF (NYSEArca: JHMM), along with a suite of multifactor sector-specific ETF strategies, allow investors to overweight targeted areas of the market. Securities are adjusted by relative price and profitability. The underlying indices may overweight stocks with lower relative prices and underweight names with higher relative prices. The indices can also adjust for profitability by overweighting stocks with higher profitability and underweighting those with lower profitability. The underlying indices also implement market-capitalization adjustments where they increase the weights of smaller companies within the eligible universe and decrease the weights of larger names.

Financial advisors who are interested in learning more about portfolio construction can watch the webcast here on demand.