Overlooked too

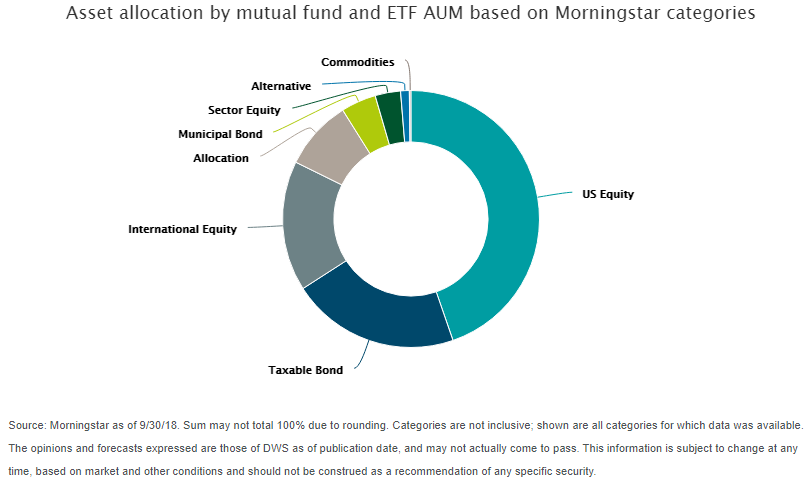

This may be especially true given that commodities are largely a forgotten sector for investors, at least as of late. In fact, according to Morningstar, just 0.2% of mutual fund and ETF assets under management are in commodities, suggesting that it is an area that is largely off the radar for most investors.

This situation may help commodities to continue to move relatively uncorrelated when compared to other asset classes. In other words, commodities—thanks to their overlooked nature—may be able to offer a unique source of diversification, at least when compared to the vast majority of traditional portfolios.

Bottom line

It is becoming more difficult to find uncorrelated assets in today’s market. The old go-to choice of international equities isn’t the same option that it used to be, and investors may need to look elsewhere for diversification in the future.

One area that remains a potentially great option in this regard is commodities. In an era of increasing correlations, commodities retain a great detail of their potency in this regard. And since evidence suggests that few investors consider this category, it can potentially be an attractive choice for those seeking diversification.