However, another interpretation could be that the extent of the selloff represents an overreaction. In fact, I rather liked a recent comment from Sean Taylor, our CIO for Asia, who said at a recent conference (paraphrasing): “investors may look back on this in a year’s time and wish that they had taken advantage of the selloff year- to – date, not just in the China A-share market but in Hong Kong, and indeed other emerging markets.”

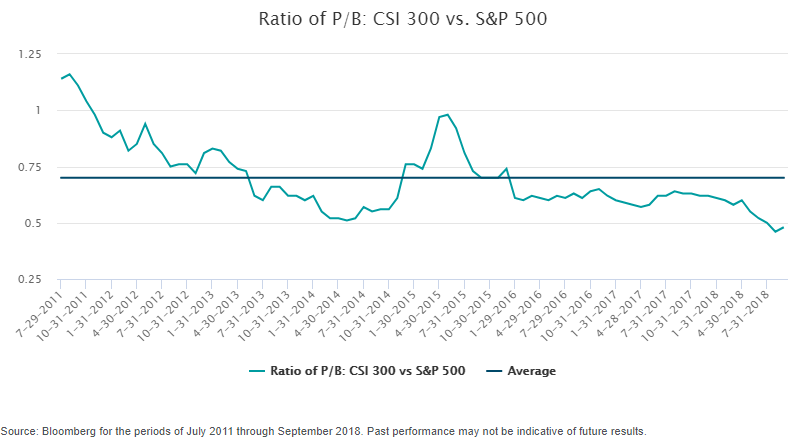

Along these lines, there’s another feature of this year’s price action that investors should note – valuations. As one would expect, as the market has slipped in China the relative Price-to-Book (P/B) discount to the U.S. market has widened. Or, put more simply, trade wars have put China on sale. For investors who are underweight the A-share market and agree with our long run prognosis that China needs to play a bigger part in portfolios, this could represent an opportunity to get up to weight at a time when the valuation discount is favorable. Figure One demonstrates. It shows the ratio of P/Bs between the Chinese CSI 300, and the S&P 500 in the U.S. The lower the line, the “cheaper” China is to the U.S. As one can see, the gap is as wide as it has been since 2011.

So those are a few thoughts on China today. I’m reminded of the old Wall Street expression to be fearful when others are greedy, and greedy when others are fearful. I wonder if you agree with me about which side of that old saying applies to China today?

Figure One: The ratio of Price-to-Book for the CSI 300 and the S&P 500 (7/2011 – 09/2018). The lower the line, the cheaper China to the U.S. (source Bloomberg)

![]()

For more news and strategy on China investing, visit our China category.