The narrative of a value comeback goes on, with increasing capital flows into value-based ETFs. Investors and advisors alike will want to consider funds like the Vanguard Value ETF (VTV).

VTV exhibits the typical characteristics of a value-based fund that primarily houses large cap stocks. When markets are pushing higher, it can capture upside while muting the effects of volatility whenever there’s downward selling pressure.

The ETF is never too top heavy in one particular stock. In fact, its vast holdings shield against concentration risk while also providing diversification across a spectrum of sectors.

“Investors with a longer-term horizon should consider the importance of large cap value stocks and the benefits they can add to any well-balanced portfolio including dividends and rock solid stability,” ETF Database analysis writes. “Companies within this segment are often considered some of the safest firms in the world and tend to be in more stable industries as well, potentially skewing some portfolios that are heavy in value securities. VTV is linked to an index consisting of roughly 400 holdings and exposure is tilted most heavily towards financials, energy, and industrials.”

The fund also offers a quarterly distribution that makes it an ideal fit for a fixed income portfolio. VTV fund is up 10% to start 2021.

The Rotation to Value

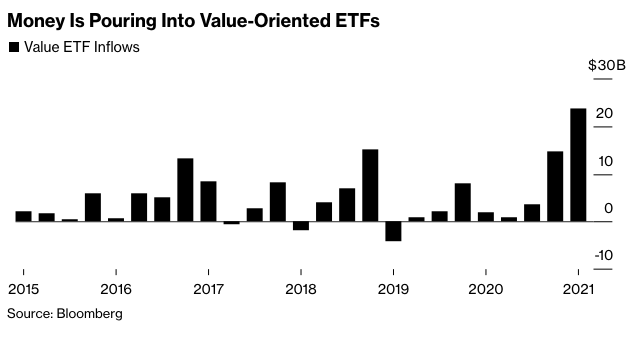

Gone are the days when the FAANGs (Facebook, Amazon, Apple, Netflix, Google) ruled the earth, at least for now it seems. The rotation to value has been exceedingly apparent through the lens of 2021 ETF inflows.

“After about a decade of growth stocks tearing up the charts, the value style of investing is having its day,” a Bloomberg article duly noted. “More than $18 billion this year — already a quarterly record — has gone into about 80 different exchange-traded funds that focus on companies considered undervalued relative to their assets, like banks.”

“If money keeps shifting this way from high-flying stocks like tech, what’s been unthinkable for many years could actually happen: A ‘deep-value’ exchange-traded fund could displace the Tesla-fueled ARK Innovation ETF (ARKK) as the next niche ETF to hoover up investor money, according to an analysis by Bloomberg Intelligence,” the article added.

For more news and information, visit the Smart Beta Channel.