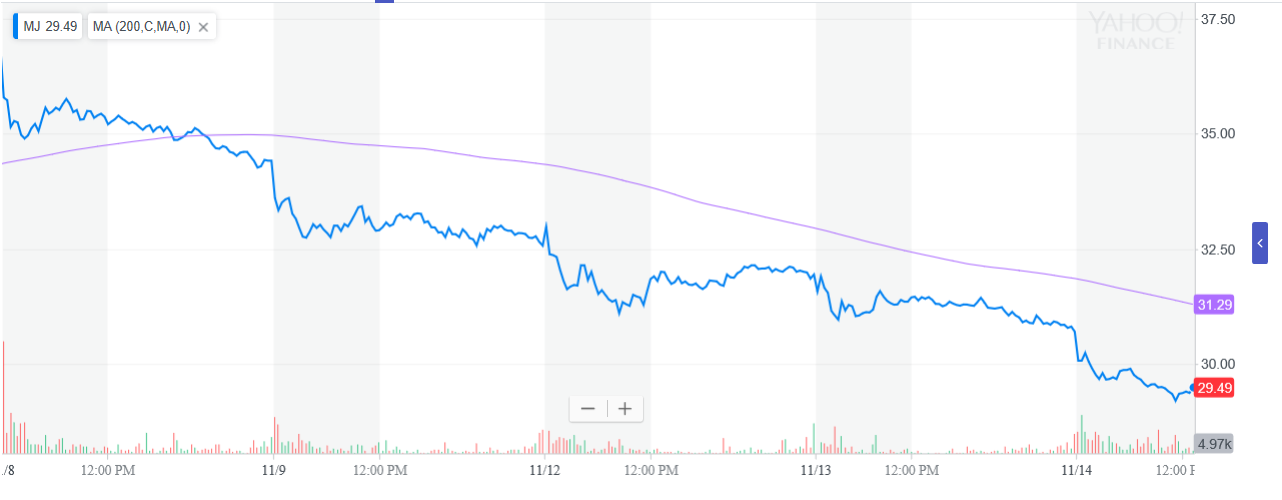

It’s been a slow burn for ETFMG Alternative Harvest ETF (NYSEArca: MJ) as it has fallen 16% in the last five days after it rallied to a November high last week following the U.S. midterm elections.

MJ was down about 5% on Wednesday as of 12:15 p.m. ET as U.S. equities have been put through another wash cycle of volatility following the elections, which saw the Dow Jones Industrial Average slide over 600 points on Monday. A hive of short sellers have been stinging MJ and its top holdings, such as Canopy Growth Corp, Cronos Group Inc and Aurora Inc.

“With the cannabis sector rallying in 2018, short sellers have added almost $1.4 billion of exposure since mid-year, hoping for a reversal in what they believe to be an over-heated and over-valued sector,” said fintech company S3 Partners. “Short interest is now $3.35 billion in the 141 securities we track in our cannabis basket. While short interest in the sector continues to grow in 2018, exposure is very extremely concentrated, with 94% of the short interest in only 10 securities.”

The slow burn has been evident the past five days as MJ has been dipping below its 200-day moving average.

Nonetheless, this recent slide could be an entry point for investors after marijuana equities heated up to exorbitant levels during the summer. A confluence of political events like the midterm elections and subsequent legislation could help MJ through the end of 2018 and beyond.

Three States Pass Cannabis Legislation

When the results of last week’s midterm election were tallied, three of four states successfully passed cannabis-related legislation. Michigan became the 10th state to legalize recreational marijuana, joining Washington, Oregon, California, Nevada, Colorado, Maine, Vermont, Massachusetts, Alaska.

Medical marijuana usage passed in Utah and Missouri, but recreational marijuana use was defeated in North Dakota.

“In our view, these midterm results combined with a strong pipeline of upcoming catalysts should serve to drive a decoupling of valuation multiples for the U.S. cannabis sector to eventually reach a premium over Canadian LP peers,” said GMP Securities analyst Robert Fagan.

As most were expecting, the midterm election results saw the Democrats gaining majority in the House of Representatives, while the Republicans maintained control of the Senate. Analysts posit that a more Democratic House would offer the least path of resistance for further marijuana-related legislation, such as the SAFE Act and STATES Act.