Sentiment extremes are a cause for caution in an otherwise bullish equity environment…

By Eric M. Clark, Accuvest

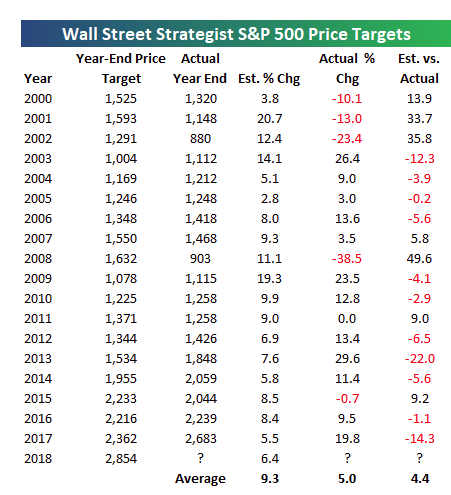

We aren’t even at the end of January and we have surpassed the average Wall Street analysts 2018 year-end target for the S&P 500! This my friends is called a MELT-UP. If this melt-up doesn’t make you a little nervous, you either have nerves of steel, aren’t paying attention, or are being a bit greedy.

Either way, a little dose of paranoia seems like a reasonably prudent emotion at this time. From a purely technical perspective, this vertical move projects to 2950-3000 where it will hit the top part of the up-channel from 2009. This is a reasonable place the markets could struggle and some sideways consolidation would be ideal. Stocks can correct in time or in pull-backs. I think you know which is preferred if you’re long equities.

![]() Below is a great chart from Bespoke showing the average Wall Street analysts 2018 target. 2854 is the consensus target and we closed at 2872 today, Friday January 26, 2018. Oh my!

Below is a great chart from Bespoke showing the average Wall Street analysts 2018 target. 2854 is the consensus target and we closed at 2872 today, Friday January 26, 2018. Oh my!

The good news: Making money and generating attractive returns feels really good.

The bad news: Vertical ascents tend to be a warning sign similar to the “last call for alcohol” warning. What happens to behavior when we believe the party is nearing its near-term zenith? People often party twice as hard, or at least that’s how I remember the story.

I lived in San Francisco during the dot-com bubble boom and burst and it’s feeling very 1999 to me. Not 1999 in economic fundamentals or tech stock valuations but 1999 in vertical stock price movements. Please remember, my comments are NOT recommendations to sell all your stocks, they are simply cautionary signs that the current move is nearing an exhaustion point and needs a rest.