When a business is in a credit crunch, a leveraged loan could provide it with the necessary capital injection to buoy its operation. This is the fixed income space in which Invesco Senior Loan ETF (NYSEArca: BKLN) manages to earn solid returns.

BKLN is based on the S&P/LSTA U.S. Leveraged Loan 100 Index where 80 percent of its total assets are focused in component securities that comprise the Index. The index itself tracks the market-weighted performance of the largest institutional leveraged loans according to market weightings, spreads and interest payments.

In addition, BKLN and the index are rebalanced and reconstituted bi-annually on June and again in December.

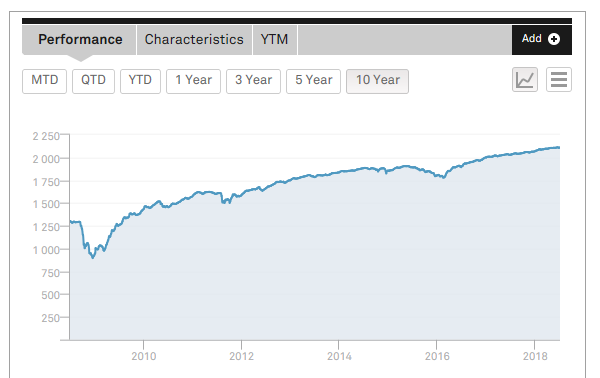

Since the financial crisis starting in 2007, the S&P/LSTA U.S. Leveraged Loan 100 Index has been on a steady run upwards. BKLN has been able to capitalize with a total return of 1.34 percent year-to-date, 2.25 percent the past year and 2.42 percent the last three years.

![]()

Senior Loan Advantage

Senior loans are typically used for business recapitalizations, acquisitions, leveraged buyouts, and re-financings. BKLN’s loan portfolio will include the purchase of loans from banks or other financial institutions through assignments or participations.

Related: 3 Fixed Income ETFs to Watch in 2nd Half of 2018

Additionally, BKLN may acquire a direct interest in a senior loan from the agent or another lender via an assignment or an indirect interest in the loan by participating in another lender’s portion of a loan. BKLN sells the loans within the portfolio through an assignment, but it may also sell participation interests in the loans in order to fund redemption requests.

The inherent risks associated with senior loans are similar to the risks of junk bonds, but have seniority in the event of borrower default so if the business is forced to sell its assets in a liquidation scenario, the senior loan will be paid first. In addition, senior loans are secured by assets whereas junk bonds are not, making them a more attractive investment option when constructing a loan portfolio.