Investors might also want to use a tool, such as our Cash Indicator, that may help limit a maximum loss scenario by selling equities and holding more cash when certain risk factors are heightened. However, we will note that cash raise triggers can hurt a portfolio if they are not properly implemented and monitored. The decision to raise cash, if done too often, can be detrimental to the long-term growth of a portfolio.

SUSTAINABLE

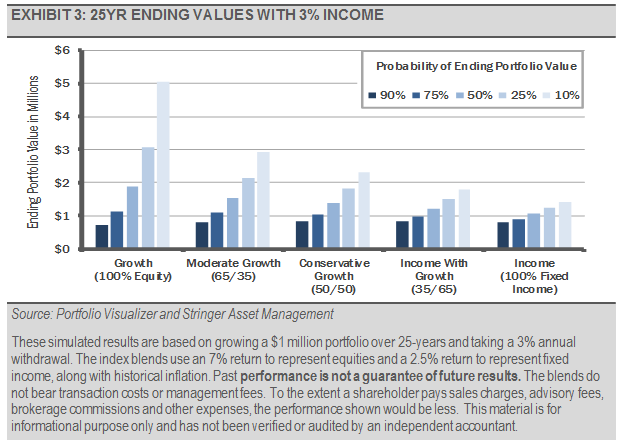

The second metric that we think is often overlooked is sustainable withdrawal rates, which need to be established before entering the distribution phase of retirement. Ideally, given an appropriately sized portfolio, allocation and withdrawal rate, investors can live off their savings without having to dip into principal to fund retirement. Our work suggests that to have at least a 75% probability of not having to dip into principal to fund a 25-year retirement, an investor should establish no more than a 3% annual withdrawal rate. A higher withdrawal rate than that may require some heroic market assumptions, taking on significantly more risk, or taking away principal from the portfolio, which is also not sustainable.

![]()

Establishing an appropriate savings plan is key, so we encourage investors to work with a Financial Advisor to determine the best plan for you. Additionally, the market projections used in the previous analysis are based on our assessment of current valuations. However, forecasts of market returns may vary greatly and will have a significant impact on the projections. We expect future equity market returns to be somewhat muted compared to the returns we have experienced recently due to heightened valuations. For example, in our piece What The Earnings Yield Can Tell Us About The Future, we showed that the S&P 500 Index has returned approximately 7% on average per year when trading near its current valuation.

Still, one cannot control the market, so investors should focus on the things they can control: saving, spending, and their allocation to the markets. Working with a Financial Advisor to develop a plan that is right for their needs, and to help continually navigate and adjust to life’s constantly changing conditions is the first and most important step for an investor to achieving financial independence during their retirement.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

Index Definitions:

S&P 500 Index – This Index is a capitalization-weighted index of 500 stocks. The Index is designed to measure performance of a broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Bloomberg Barclays U.S. Aggregate Bond Index – This Index provides a measure of the U.S. investment grade bond market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States with at least 1 year remaining to maturity