As a way to jump on new developments and the growth potential of advancing technologies, investors may consider gaining exposure to disruptive tech like robotics and artificial intelligence.

During the recent annual ETF Trends Virtual Summit, an online virtual conference environment where financial advisors learned about current ETF issues, Chris Buck, Head of Capital Markets & Sales at ROBO Global, argued that the robotics and artificial intelligence industry is set on an exponential growth path.

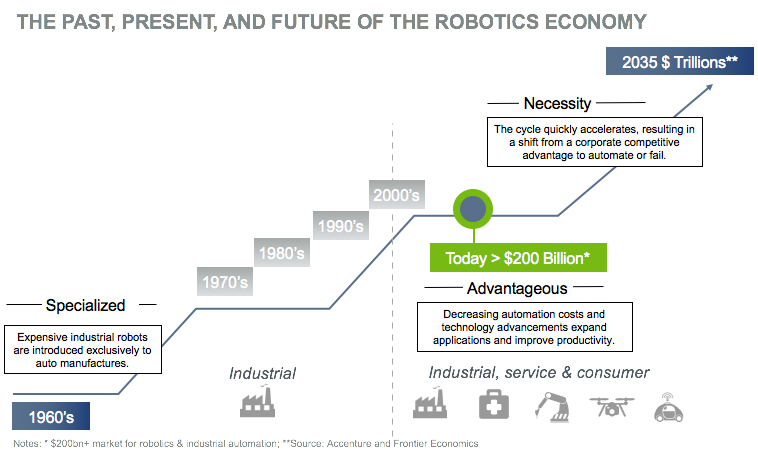

Industrial robots were first introduced exclusively to auto manufacturers in the 1960s, and by today, the robotics, automation and artificial intelligence industry has grown to over $200 billion. As automation costs decline and technology advances, applications for robotics and artificial intelligence have expanded, helping improve productivity across a range of industries. Looking ahead, the robotics, automation and artificial intelligence segment could grow to over $1 trillion by 2035.

![]()

The declining costs in technology has driven increased robotics investments. Meanwhile, big data has fueled growth in artificial intelligence. The advancements touched upon many industries, helping improve areas like logistics automation, e-commerce growth and healthcare, among others. Meanwhile, more money is being funneled into the space. We are witnessing increased merger and acquisition activity, and more startup funding is targeting the robotics segment.

Robotic technology is being deployed in a wide array of industries, including manufacturing, logistics and automation, 3D printing, consumer, security and surveillance, food and agriculture, healthcare and energy.