![]()

Manufacturing Automation

China is ” Manufacturing automation nation,” no longer the low-cost labor provider

Calling China the “automation nation,” HSBC researchers Helen Fang, Michael Hagmann, Richard Schramm and Anderson Chow note that demand for robots is “going into overdrive.”

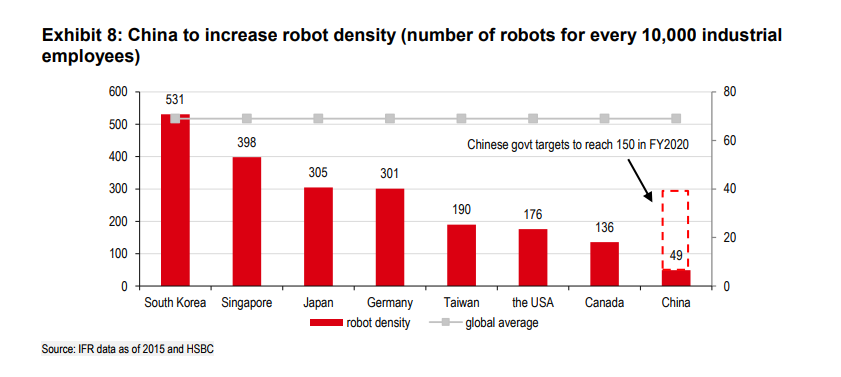

Around the globe, there is an average of 69 robots per 10,000 workers. By 2020 there are projected to be 150 robots per 10,000 workers, nearly tripling the current standard and displaying almost a 3x growth rate. Nearly 1/3 of all robotic demand is coming from China.

As the Chinese workforce begins to age and expects higher wages, they are no longer the low-cost producer in the region. With the assistance of government policy, an embrace of automation is driving interest in corporations such as Apple to set up shop in the area.

CEO Tim Cook told a Fortune Magazine summit that he likes the integration of a “craftsman sort of skill” with advanced robotics, where a focus on tooling management is unique. “It is very rare to find the intersection of manufacturing skills with sophisticated robots,” he said. “The number one attraction is the quality of the people.”

China is offering a “potent mix” to manufacturers using for automation, but the automation road is tricky to navigate. “But while demand for industrial robots is still rising sharply in China, the nature of the market is changing,” the HSBC report noted. “It’s becoming deeper and broader as new industries follow the automation trend.”

HSBC points to Chinese automotive concerns being the primary buyers of industrial robots, but the automation trend is spreading to electronics, semiconductors, smart factories, logistics, household appliances and electric vehicles. With breakeven rates expected to reach less than one year in 2019, manufacturing automation is a trend that could see quicker adoption.

Where do most of these robots come from? Largely Japan, at present. From 2015 to 2016, 70% of imported industrial robots came from Japan, with only 8% coming from domestic Chinese producers. 35% came from other global suppliers. In this regard, HSBC likes Japanese automation provider FANUC as one of their top investment picks.

![]()

This article was republished with permission from Value Walk.