Benchmark Treasury yields ticked higher as the Federal Reserve will end a two-day policy meeting on Thursday that will be followed by an interest rate decision that most are expecting will result in the federal funds rate remaining unchanged.

The Fed hiked rates 25 basis points in September to bring the current rate to 2.25, but while the capital markets forecast a rate change for November is unlikely, they are expecting the central bank’s rate-hiking policy to continue with another 25 basis points in December.

“In terms of the [Federal Open Market Committee] statement, we suspect that it is likely to remain largely unchanged from the September communique,” said Omair Sharif, senior U.S. economist for Société Générale.

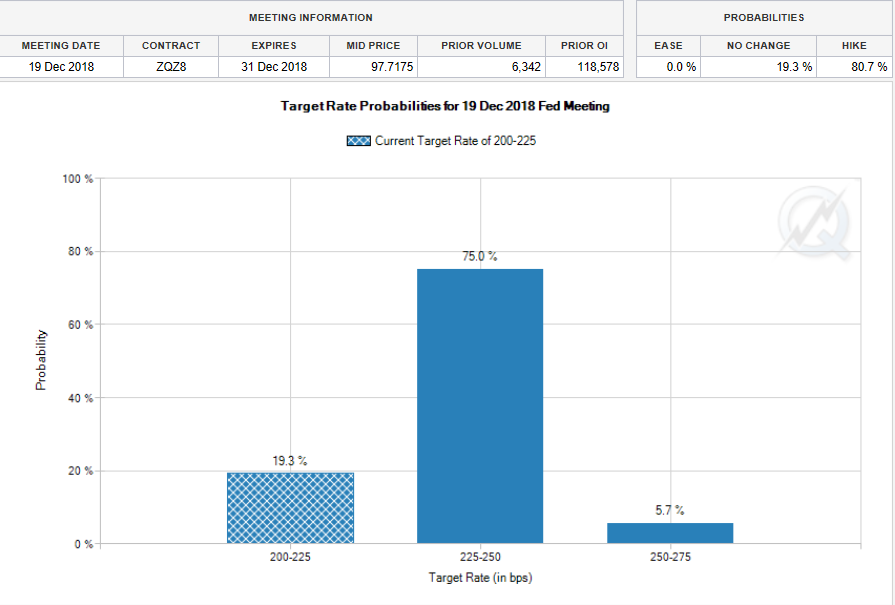

Based on the latest CME FedWatch Tool, there’s a 75% chance of a rate hike in December.

As of 12:15 p.m. ET, the 10-year note went up to 3.232 and the 30-year note followed, heading higher to 3.434. The two-year note ticked up to 2.961, while the five-year note edged down to 3.083.

As of 12:15 p.m. ET, the 10-year note went up to 3.232 and the 30-year note followed, heading higher to 3.434. The two-year note ticked up to 2.961, while the five-year note edged down to 3.083.

As the Democrats gained control of the House of Representatives and the Republicans maintained majority in the Senate, the markets did as expected with no curveballs thrown.

“Markets have more time to digest the U.S. midterm election outcome, but we don’t expect shocking moves. The split U.S. Congress was by and large discounted. The slightly softer U.S. yields and dollar overnight suggest a setback in the reflation trade, but it’s merely splitting hairs,” said analysts at KBC Bank, in a note. “We don’t expect a lasting impact.”

Prior to the election, political analysts were already expecting a split Congress following the results, which would increase political gridlock–general consensus is that this typically benefits the capital markets. However, market analysts predicted that this political divide would do little in terms of impacting the capital markets.