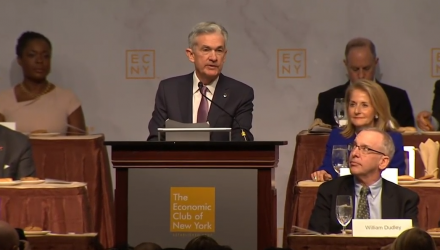

With the latest bouts of volatility roiling the capital markets, investors were hanging on every word of Federal Reserve Chairman Jerome Powell’s speech at the Economic Club of New York on Wednesday and they apparently liked what they heard as the Dow Jones Industrial Average soared past 520 points as of 2:45 p.m. ET following Powell saying that rates are “just below neutral.”

“Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy — that is, neither speeding up nor slowing down growth,” said Powell.

Powell noted that the economy is “near max employment, price stability” and major asset class valuations are “not far in excess,” which could mean there may be more room to run for U.S. equities. Furthermore, Powell states that the economy is growing “well above most estimates” and that “there is a great deal to like about this outlook.”

The CME Group’s FedWatch Tool, an algorithm that calculates the probability of a rate hike in a given month, is now showing an 82.7% chance the Federal Reserve will institute a fourth rate hike for December. Powell’s latest comments come as various Fed members signaled dovish tones to various media outlets.

Related: Jim Cramer: Markets in ‘One of the Worst Times in a Long Time’ as Yields Rise, Stocks Fall

Federal Reserve Bank of New York President John Williams was keen to sticking with hiking rates–somewhat.

“We’ll be likely raising interest rates somewhat but it’s really in the context of a very strong economy,” Williams said at a community event in New York on Monday. “We’re not on a preset course. We’ll adjust how we do monetary policy to do our best to keep this economy going strong with low inflation.”