According to Cramer, a look behind the curtain of Monday’s 600-point slide into the red reveals the movement of money that is head-scratching, particularly during this time of the year.

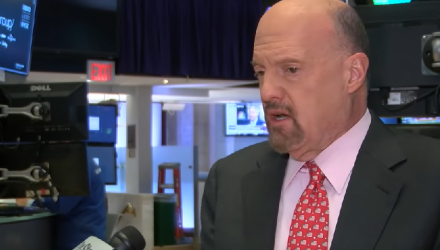

“The thinking behind today’s action is surprisingly simple: money managers are buying the winners and selling the losers,” said Cramer on his CNBC show ‘Mad Money.’ “Unfortunately, there are a heck of a lot more losers than winners, and I want to put that into context because such behavior, frankly, is highly unusual this close to the end of the year.”

Last week, the Federal Reserve completed a two-day monetary policy meeting that resulted in unchanged rates, but the general consensus in the markets is that a final rate hike to end 2018 is imminent. In fact, the CME Group’s FedWatch tool is predicting a 75.8% chance of a rate hike come December.

Cramer ventures to think that one major trigger event is necessary in order for the Fed to continue its rate-hiking measures through 2019. In particular, the U.S. and China coming to some sort of tangible trade deal–a possibility given that U.S. President Donald Trump and Chinese President Xi Jinping will be in the same room at the G20 summit on November 30 at Buenos Aires in Argentina.

“We need to see a trade deal with China or some sign that the Federal Reserve will wait and see before it hits us with more rate hikes next year,” said Cramer. “We’ve been getting weaker for some time and the Fed doesn’t seem to care — they’re still very committed to the ‘destroy the economy in order to save it’ approach.”

For more real estate trends, visit ETFTrends.com