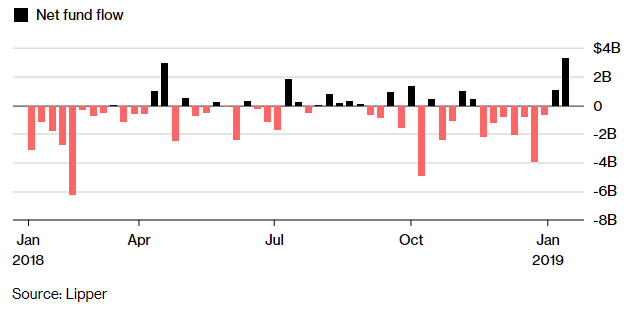

With the markets off to a solid start in 2019, investors are starting to dip back into the high yield waters. In fact, they dove in with $3.28 billion in flows the past week.

This latest influx of capital follows $1.05 billion the previous week–signs that a risk-on sentiment is slowly creeping back into the markets, making the case for high-yield bond ETFs.

“There’s a decent bid for things that got beat up the most over the last month or two,” said Zachary Chavis, portfolio manager at Sage Advisory Services.

Names like the iShares iBoxx $ High Yield Corp Bond ETF (NYSEArca: HYG) and the SPDR Bloomberg Barclays High Yield Bond ETF (NYSEArca: JNK) have been seeing more inflows the past week. According to data from XTF.com, fund flows within the past week topped $167.85 million for HYG, while JNK brought in $659.70 million–both taking two of the top 10 spots for fixed income fund flows the past week.