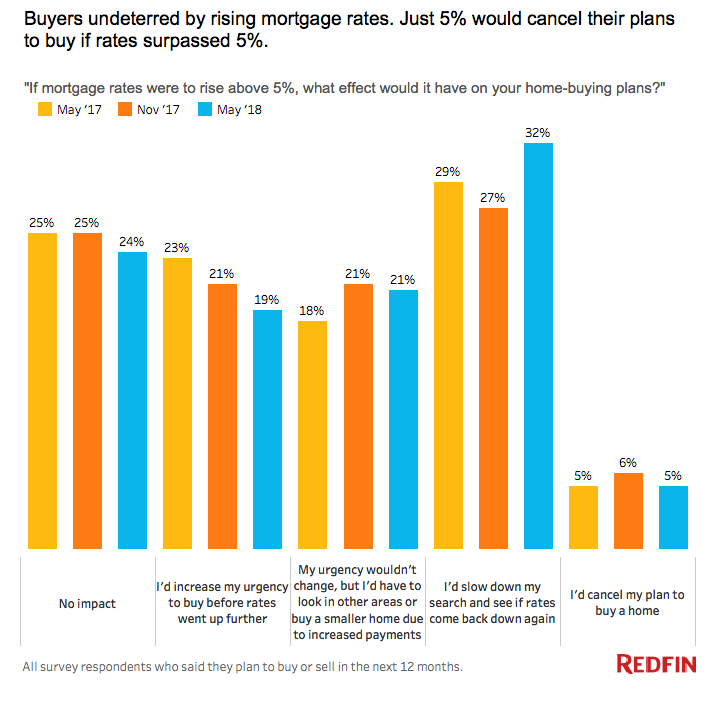

According to the National Home Builders Association, average mortgage rates jumped by more than 30 basis points in the second quarter to 4.67% from 4.34% the previous quarter, but a study by real estate brokerage Redfin shows that prospective homebuyers are still forging on with seeking home ownership.

Based on the Redfin study, 32% would slow down their search and wait to see if rates decreased again, which reflected an increase from from 27% in November and 29% in May 2017. Furthermore, 21% said a 5% mortgage rate would cause them to look in other areas or buy a smaller home, which was unchanged from November and up from 18% a year ago. Lastly, 19% would increase their urgency to buy a home before interest rates were higher–down from 21% in November and from 23% a year ago.

“Homebuyers are well aware that higher mortgage rates means higher monthly payments, but mortgage rates remain very low, historically, and buyers will make compromises,” said Taylor Marr, senior economist at Redfin. “Most of the pressure buyers are feeling is from competition for a very limited number of homes for sale. The fact that such a small share of buyers will scrap their plans to buy a home if rates surpass 5 percent reflects their determination to be a part of the housing market.”

![]()

The data reflects the resiliency of buyers despite an economic landscape where the Federal Reserve is hinting at more rate hikes to come in September. Backed by a bull run in the capital markets and data showing that gross domestic product increased 4.1% in the second quarter, the prevailing notion is that rising rates are almost certain.