Three of the biggest homebuilder ETFs have been feeling the pangs of the current economic landscape of rising rates, such as iShares US Home Construction ETF (BATS: ITB)–down 12.53% year-to-date, SPDR S&P Homebuilders ETF (NYSEArca: XHB)–down 10.26% YTD and Invesco Dynamic Building & Const ETF (NYSEArca: PKB)–down 11.90 YTD%.

Despite this, all is not lost according to Robert Dietz, a chief economist and senior vice president for Economics and Housing Policy at the National Association of Home Builders.

“Rising interest rates are a concern in the housing sector,” Dietz said in a blog. “Higher rates increase the cost of builder and developer debt financing, as well as raise the cost of buying a home with a mortgage. However, with respect to housing affordability, it’s important to remember that the primary reason interest rates are higher is that the economy is performing well.”

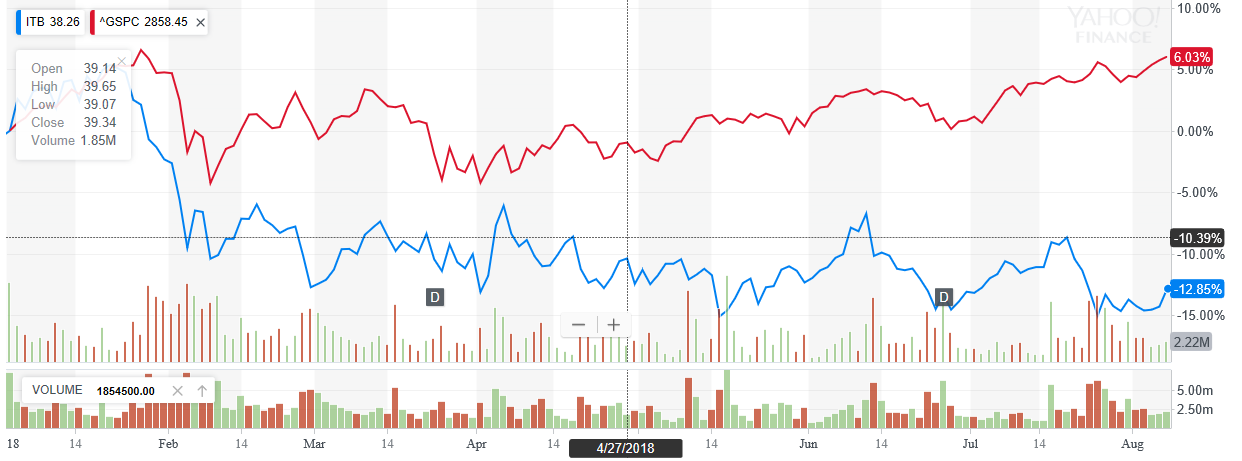

Unfortunately, while the rest of the capital markets appear to be moving forward, it has left the housing sector in the rearview mirror. The biggest home builder ETF in terms of total assets, ITB, has largely diverted from the direction of the S&P 500 from a chart perspective.

![]()

Despite this, economic models at the NAHB are showing that home builders can weather the storm of higher interest rates.