Related: An ETF That Taps Into Closed-End Funds for High Yields

Investment-Grade Debt Issues

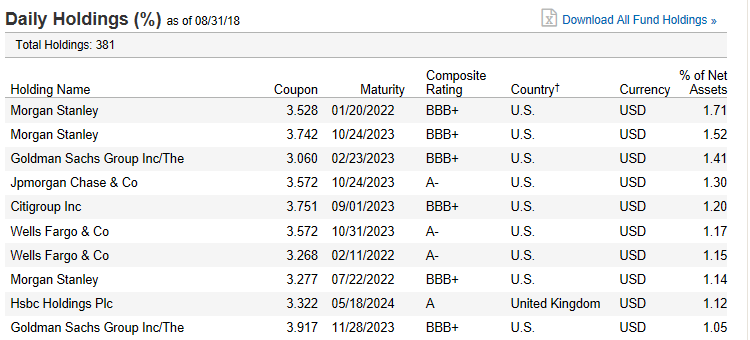

One distinct advantage of FLTR is that the fund allocates capital into debt issues that are of investment-grade as opposed to debt that may offer higher yields, but expose investors to more credit risk. Taking a look at its latest holdings, FLTR holds debt from recognizable bank names, such as Morgan Stanley, Citigroup and Wells Fargo.

![]()

FLTR also diversifies its debt holdings with investments in companies domiciled in other parts of the world, such as the United Kingdom, Switzerland, Japan, Germany, Australia, Sweden, and the Netherlands.

FLTR also diversifies its debt holdings with investments in companies domiciled in other parts of the world, such as the United Kingdom, Switzerland, Japan, Germany, Australia, Sweden, and the Netherlands.

FLTR seeks to replicate the price and yield performance of the MVIS® US Investment Grade Floating Rate Index, which is comprised of U.S. dollar-denominated floating rate notes issued by corporate entities or similar commercial entities that are public reporting companies in the United States and rated investment grade. Based on Yahoo! Finance numbers, FLTR has been able to generate 1.35% year-to-date and 2.45% within the past year.

For more news on rising rates, visit the Rising Rates Channel.