“Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy — that is, neither speeding up nor slowing down growth,” said Powell last week.

Powell noted that the economy is “near max employment, price stability” and major asset class valuations are “not far in excess,” which could mean there may be more room to run for U.S. equities. Furthermore, Powell states that the economy is growing “well above most estimates” and that “there is a great deal to like about this outlook.”

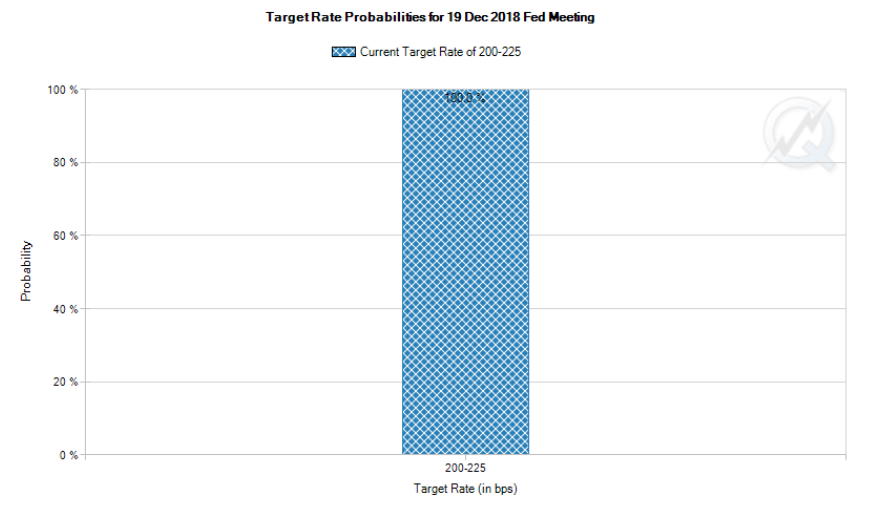

The CME Group’s FedWatch Tool, an algorithm that calculates the probability of a rate hike in a given month, is now showing an 100% chance the Federal Reserve will institute a fourth rate hike for December. Powell’s latest comments last week came as various Fed members signaled dovish tones to various media outlets.

Related: 3 ETFs to Consider as a Possible Liquidity Crisis in BBB Bonds Looms

For more trends in fixed income, visit the Rising Rates Channel.