Related: Will the Federal Reserve Raise Interest Rates in December?

Denigrating Fed a Recurring Theme

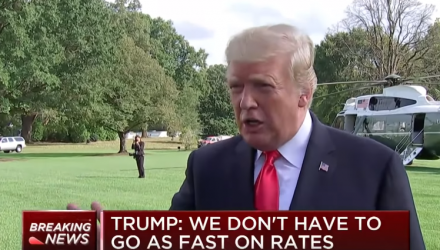

As the major indexes head into bear market territory, President Trump is keen to denigrate the Fed when the capital markets go sour. Following the latest rate hike in September that saw the central bank raise the federal funds rate by 25 basis points to 2.25, Trump took the opportunity at a New York press conference to express his discontent.

“Unfortunately, they just raised interest rates,” said Trump. “I am not happy about that.”

The president did, however, say the Fed’s move was justified as a result of the strength seen in the economy, but also said, “but basically I am a low-interest-rate person.”

In an interview with CNBC earlier this year, Trump already took a shot at the Fed, saying he’s “not happy” about the Federal Reserve’s latest monetary policy moves to raise interest rates. In typical Trump fashion, the president took to social media to say that the U.S. “should not be penalized because we are doing so well.”

….The United States should not be penalized because we are doing so well. Tightening now hurts all that we have done. The U.S. should be allowed to recapture what was lost due to illegal currency manipulation and BAD Trade Deals. Debt coming due & we are raising rates – Really?

— Donald J. Trump (@realDonaldTrump) July 20, 2018

Meanwhile, if a rising chorus of concerns starts to make itself heard regarding higher interest rates–for example, banks fretting that higher rates are dampening their lending businesses or the major indexes continuing their doldrums–this could cause the Fed pause to pause rate hikes in 2019. Until his reelection bid in 2020, Trump doesn’t want the economy to experience an unceremonious fall from grace as a result of rates and as such, any more tightening of monetary policy by the Fed will certainly come under the president’s scrutiny.