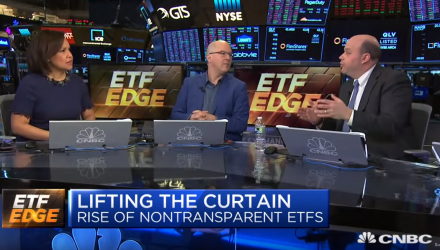

CNBC’s Bertha Coombs discussed active non-transparent ETFs on this week’s ETF Edge show, bringing in ETF Trends CIO and Director of Research, Dave Nadig, along with CFRA Research’s Chief Investment Strategist, Todd Rosenbluth, to weigh-in.

According to Coombs, American Century is set to make history as the first asset manager to launch a non-transparent ETF. This comes after a wave of SEC approvals surrounding the new structure last year.

Rosenbluth was optimistic where things are headed for active non-transparent ETFs. He first noted how this is a way for firms to offer ETF versions of actively-managed mutual fund strategies. The key difference – “Instead of having to report their holdings daily, the way that every other ETF tends to do, they’ll be able to disclose the holdings on a periodic basis, and mask what’s going on inside, letting the active manager be able to buy and sell as they see more appropriately fit.”

So, as far as demand, Rosenbluth, speaking for CFRA, believes there is a demand for these products. Investors are looking and fans of active management today, but do not have a lot of choices. As it stands, the demand only seems small because the supply is small too.

The Tax Efficiency Advantage

As far as why the ETF aspect is important, Rosenbluth noted how it comes down to the tax efficiency, creating an advantage for ETF investors. In an ETF, the trading taking place only has taxing apply when the investor is specifically making the trades themselves.

Nadig then chimed in to speak to the possible reduction of return based on this strategy, noting how the ETF structure can keep that from happening.

“Unlike a mutual fund, your personal experience is uniquely yours. In a mutual fund, if a bunch of people head for the exits and it’s been up a bunch, you could get hit with their tax bill and be upwards by their trading,” Nadig explained. “But a trader moving in and out won’t affect you as a long term holder at all, because you’re going to be trading those shares of the ETF on the open market.”

Nadig believes this is an interesting way to be more aggressive in putting money in and out of those active strategies, without having to wait. Rosenbluth also added how the active management component will more than likely be seen as a buying opportunity for those looking to pick up things that are selling off.

Watch This Look at Active Non-Transparent ETFs:

For more market trends, visit ETF Trends.