By ProShares

It’s no secret that the retail landscape is changing. Bricks-and-mortar retailers are under immense pressure. E-commerce is threatening to take over retail as consumer habits change, shopping moves online, and physical stores struggle to remain viable. Shoppers are moving out of the aisles and onto the Internet–going from J.C. Penney and Macy’s to Amazon and Alibaba.

The transformation of retail is still in the early innings, as key indicators suggest.

- By 2020, online sales growth is expected to outpace bricks-and-mortar retailers by 3 to 1 and account for $4 trillion of the global retail market.

- Stock returns for physical retailers have been weak, and profit margins are approaching lows not seen since the 2008 recession.

- Experts predict that almost 25% of the nation’s shopping malls will close in the next five years.

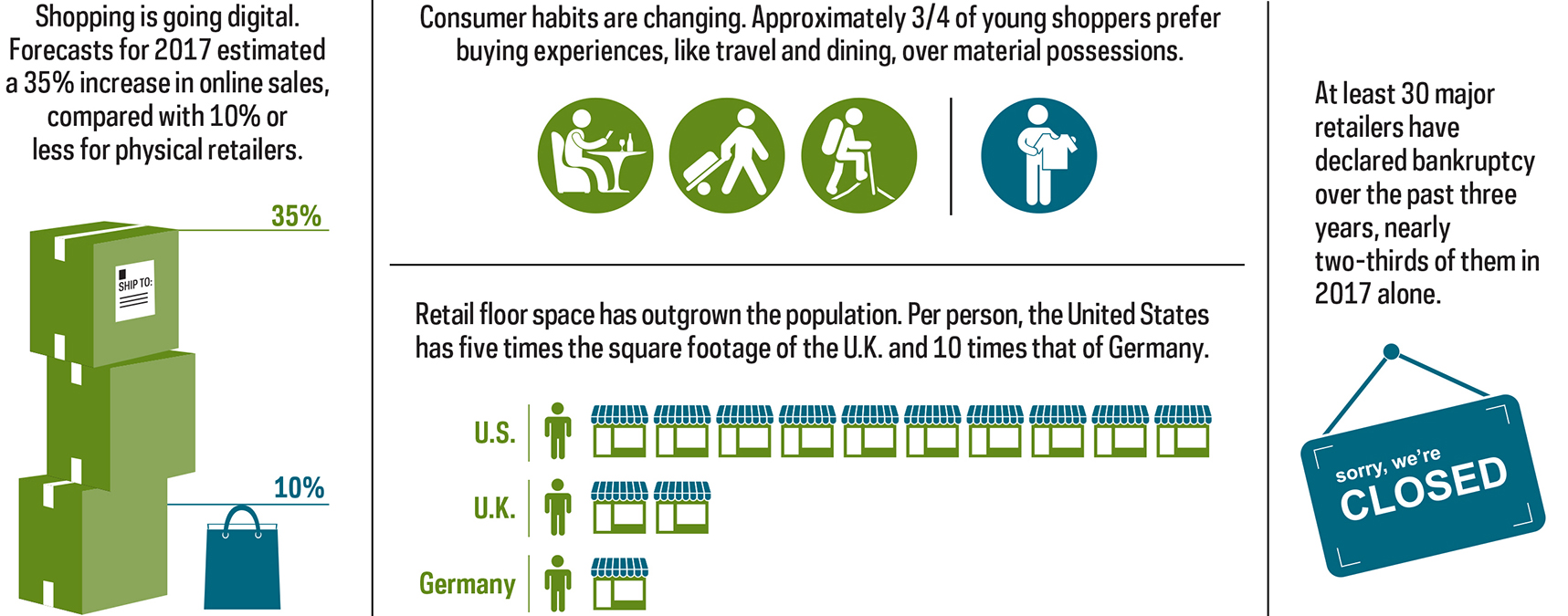

What’s driving the decline of bricks-and-mortar retailers

![]()

Meanwhile, the online retail marketplace is soaring

What does this mean for investors?

The changing retail landscape may present opportunities for investors interested in concentrating on a transformative trend in a key part of the economy. Investors now have access to strategies offering short exposure to traditional bricks-and-mortar retail companies and others that focus on the potential growth of online companies. For more information, visit ProShares’ website.

Any forward-looking statements herein are based on expectations of ProShare Advisors, LLC at this time. Whether or not actual results and developments will conform to ProShare Advisors, LLC’s expectations and predictions, however, is subject to a number of risks and uncertainties, including general economic, market and business conditions, changes in laws or regulations or other actions made by governmental authorities or regulatory bodies, and other world economic and political developments. ProShare Advisors, LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Sources include: ProShares; Bloomberg; Goldman Sachs Investment Research; Bankruptcy Data; U.S. Census Bureau; eMarketer; Euromonitor; IBGE; IPCA; AKIT; Japan METI; iResearch; NBS China; comScore; U.S. Department of Commerce for Retail; Cushman and Wakefield; Thompson, Derek, “The Great Retail Apocalypse of 2017,” The Atlantic, 4/10/17; Peterson, Hayley, “The retail apocalypse has officially descended on America,” Business Insider, 3/21/17; Peterson, Hayley, “Wall Street bank says a quarter of shopping malls will close in 5 years,” Business Insider, 5/31/17; Beall, George, “The surprising retail habits of millennial shoppers,” The Next Web, 9/11/17; Andrews, Travis, “America is ‘over-stored’ and Payless ShoeSource is the latest victim,” The Washington Post, 4/5/17.