U.S. equities are ending the year with record highs in the major indexes like the Nasdaq Composite and S&P 500, but December could end up being the proverbial cherry on top, which could make it a month to remember to end a strong 2019.

“December is the best month of the year. The S&P is up 1.6% on average. It also has the highest frequency of advances, up 76% of the time,” said Sam Stovall, chief investment strategist at CFRA. December is also the least volatile month of all, but it could see some bumps.

“The market tends to go through a mid-December low, which then represents a good buying opportunity, at least through the end of January,” Stovall added. “I don’t think we need a big pullback or a correction. A mid-single digit decline would be sufficient.”

Per a CNBC report, market performance “for the entire year also bodes well for a positive move into year-end, according to Bespoke. Since 1928, when stocks are up 20% or more by Thanksgiving, like this year, the S&P 500 usually ends the year even higher, with an average gain of 1.8% between Black Friday and New Year’s Eve, Bespoke noted.”

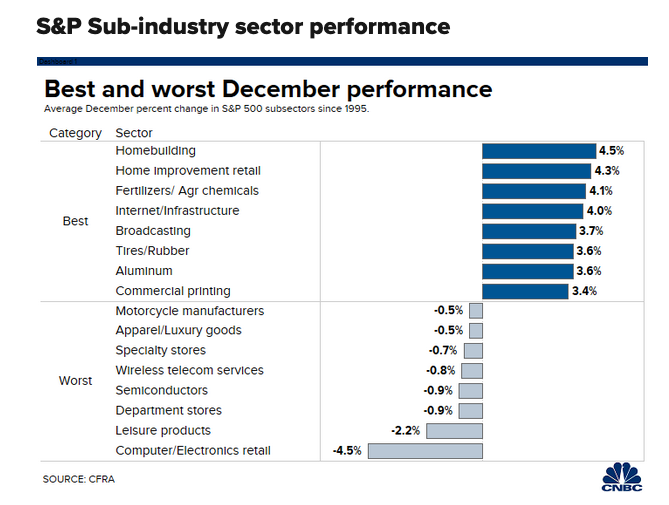

When it comes to specific sub-sectors, homebuilders attract interest in December as investors expect strong building activity in the spring and summer.

“You want to buy now what nobody wants to own,” said Stovall.

Investors looking for an opportunity in December stock strength can look at the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI).

RWUI features:

- Seeks investment results, before fees and expenses, that track the Russell 1000®/FTSE All-World ex-US 150/50 Net Spread Index (the “index”).

- The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in securities that comprise the Long Component of the index or shares of ETFs on the Long Component of the index.

- The index measures the performance of a portfolio that has 150% long exposure to the Russell 1000® Index (the “Long Component”) and 50% short exposure to the FTSE All-World ex-US Index (the “Short Component”).

Investors looking to play the other side can use the Direxion FTSE International Over US ETF (NYSEArca: RWIU) to capitalize on international equities will outdoing U.S. equities. RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex US/Russell 1000 150/50 Net Spread Index, which measures the performance of a portfolio that has 150 percent long exposure to the FTSE All-World ex US Index and 50 percent short exposure to the Russell 1000® Index.

For more market trends, visit ETF Trends.