Following a volatile end to 2018, investors are picking themselves up and dusting themselves off in 2019 by looking for smoother paths to gains. Before diving back into the markets, investors have the mindset of deploying capital more strategically, but how can an investors accomplish this?

The answer can be through the use of alternative and thematic investment strategies. However, one of the challenging aspects advisors face with this approach is the plethora of options available for their clients, especially in the exchange-traded fund (ETF) space.

The Out of the Box; Alternative and Thematic Tools to Better Diversify Client Portfolios panel:

- Sylvia Jablonski, Capital Markets-Institutional Strategist, Managing Director, Direxion

- Meb Faber, Chief Executive officer and Chief Investment Officer, Cambria Investment Management

- Bill DeRoche, Chief Investment Officer and Portfolio Manager, AGFiQ

The first quarter has been a good one for U.S. equities, but with the wall of worry growing–inverted yield curves, trade wars, global growth, and a more dovish Federal Reserve–it has investors wondering what’s next? More volatility? Little volatility?

“I think like a lot of people–I’m kind of scratching my head,” said Faber.

When volatility appears in a big way, this can be beneficial to the short-term trader. ETF issuers are now offering a plethora of options, such as leveraged and inverse products to give investors access to an investment space that was typically relegated to only high-net worth individuals or institutions.

With the transparency and liquidity of an ETF wrapper that incorporates multiple hedge fund strategies, it opens up the arena to all types of investors irrespective of net worth–the case for using alternative and thematic tools in the current market landscape. This can benefit investors, particularly during a market drawdown where hedging and inverse opportunities can be had.

So how do investors attack risk in the markets?

“The best way to hedge risk is don’t take it in the first place,” said Faber.

“The best way to hedge risk is don’t take it in the first place,” said Faber.

This has opened up the ETF marketplace for innovation, which Direxion Investments has taken with the introduction of its Relative Weight ETFs. Whether an investor thinks U.S. equities in general will outpace international equities or emerging markets will supplant developed markets in terms of performance, the Relative Weight ETFs give investors this unique capability without having to spread capital over a multitude of positions.

“They’re definitely for buy and hold investors so they aren’t leveraged,” said Jablonski, referring to Direxion’s vast array of other products that are leveraged for short-term tactical traders.

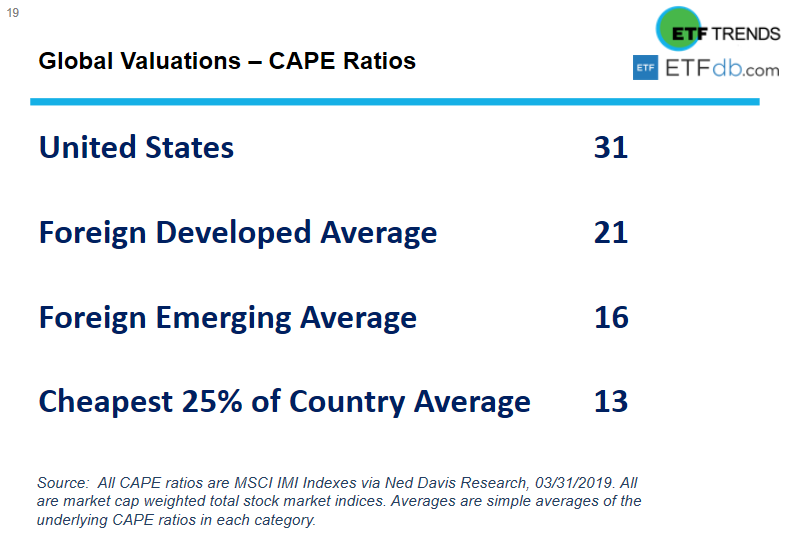

Investors should also keep international and overseas investing in mind when it comes to getting tactical. Faber presented the CAPE ratios as the case for identifying cost-effective opportunities globally.

Tail risk strategies are also an option investors can use to hedge risk–DeRoche introduced AGFiQ U.S. Market Neutral Anti Beta ETF (BTAL). BTAL seeks performance results that correspond to the price and yield performance,of the Dow Jones U.S. Thematic Market Neutral Anti-Beta Index, which is a long/short market neutral index that is dollar-neutral–as such, it identifies long and short securities positions of approximately equal dollar amounts.

“We want this low beta-high beta anomaly to drive the returns of the fund,” said DeRoche.

ETFs mentioned during the presentation:

- Direxion Russell Large Over Small Cap ETF (NYSEArca: RWLS)

- Direxion Russell Small Over Large Cap ETF (NYSEArca: RWSL)

- Cambria Global Value ETF (NYSEArca: GVAL)

- Cambria Tail Risk ETF (Cboe: TAIL)

- AGFiQ U.S. Market Neutral Anti Beta ETF (BTAL)

Missed the Virtual Summit? Make sure to check back when the complete Virtual Summit is available on demand: https://www.etftrends.com/virtual-summit.