So what did investors do when the markets were awash in volatile-laden sell-offs the last week as a result of U.S.-China tariff battles? They went to McDonald’s and Starbucks–consumer staples–and this could be a persisting trend that could boost the Direxion MSCI Defensives Over Cyclicals ETF (NYSEArca: RWDC)

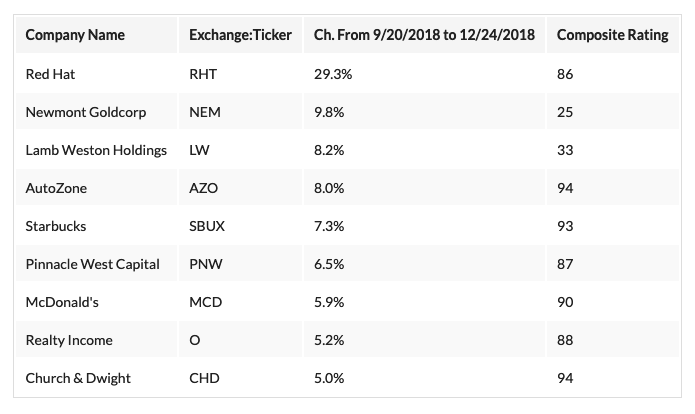

In addition to traditional safe havens like bonds and gold, investors sought names like McDonald’s and Starbucks, which saw both rise 5.9 percent and 7.3 percent, respectively on Wednesday. These types of defensive plays could get more interest after the volatility that plagued the markets.

As such, some names that could garner more purchases include the following:

Eyeing the Fed Next?

With a U.S.-China trade deal already priced into the markets and subsequently getting burned when the markets took a dive the past week, investors are now looking for another trigger event–a rate cut–except the Federal Reserve passed on that notion and stayed put recently.

“In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes,” the Federal Open Market Committee’s policy statement read.

Fed Chairman Jerome Powell reiterated his ongoing message of patience as the wait-and-see approach by the central bank continues to persist.

“The market was pricing in nothing but rate cuts,” said Gennadiy Goldberg, United States rates strategist at TD Securities. “I think he was trying to push back against the idea that the economy is turning lower and the Fed can never generate inflation.”

With the markets digesting the lack of a rate cut, the major indexes moving to the downside could signal that more defensive maneuvers might be necessary moving forward. As such, investors can look to relative weight exchange-traded funds (ETFs) to play either side of the move.

Playing Defense in Today’s Market

For investors looking for continued upside in U.S. cyclical sectors over defensive sectors, the Direxion MSCI Cyclicals Over Defensives ETF (NYSEArca: RWCD) offers them the ability to benefit not only from cyclical sectors potentially performing well, but from their outperformance compared to defensive sectors.

Conversely, if investors believe that U.S. defensive sectors will outperform cyclical sectors, the Direxion MSCI Defensives Over Cyclicals ETF (NYSEArca: RWDC) provides a means to not only see defensive sectors perform well, but a way to capitalize on their outperformance compared to cyclical sectors.

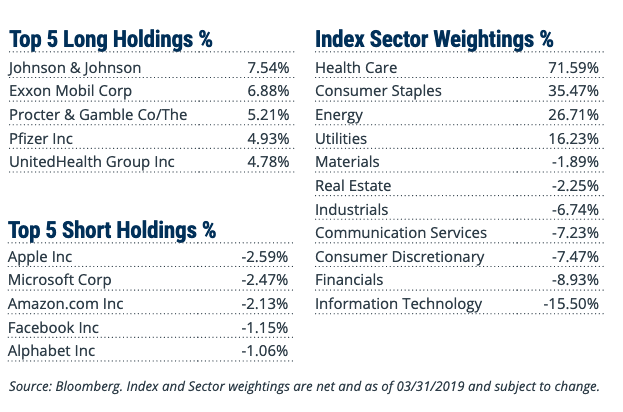

RWDC tilts towards defensive sectors like health care and consumer staples as shown in the fund’s breakdown. Conversely, it shorts names like the top technology giants that skew towards momentum.

RWDC seeks investment results that track the MSCI USA Defensive Sectors – USA Cyclical Sectors 150/50 Return Spread Index. The Index measures the performance of a portfolio that has 150% long exposure to the MSCI USA Defensive Sectors Index (the “Long Component”) and 50% short exposure to the MSCI USA Cyclical Sectors Index (the “Short Component”).

If investors feel that defensive sectors will get the nod moving forward, they best give RWDC a closer look.

For more market trends, visit ETF Trends.