From Direxion

While phase one of the U.S.-China trade deal remains unsigned, both parties have agreed to terms that takes steps towards removing a substantial overhang in international markets, especially those in emerging markets. Investors began to anticipate that development, which helped EM cut into the lead that developed markets built over the last year as investors favored the less risky segment of international equity markets.

Due to their place in the global supply chain, emerging markets are highly dependent on global trade, and the group should benefit from a de-escalation of trade tensions. We believe the recent development should provide a boost to emerging markets even as they hit an eighteen-month high.

WHAT WE’VE SEEN

- Emerging markets are outperforming by nearly 3% in December, which is their best month relative to developed markets since January. Evidence of EM’s recent struggles is that the MSCI Emerging Markets IMI Index has not seen two months of consecutive outperformance relative to the MSCI EAFE IMI Index in over a year.

- In addition to the more favorable macro backdrop, revisions for emerging market companies have turned upwards, which may help to provide a catalyst for the valuation argument that has been in place for the better part of 2019.

Emerging Markets Are On Fire In December

Source: Bloomberg, L.P. as of December 17, 2019. Data displays the monthly total returns of emerging markets defined as the MSCI Emerging Markets IMI relative to developed markets defined as the MSCI EAFE IMI. Past performance is not indicative of future results. One cannot invest directly in an index.

MONEY IN MOTION

- With $3.77 billion into developed markets and $4.21 billion into emerging markets over the last month, investor interest in ETFs offering international exposure, as a whole, are showing signs of acceleration heading into year-end. Over the last few days, EM ETFs have taken a narrow lead relative to DM ETFs.

- As recently as mid-September, both groups of ETFs were seeing heavy outflows and sitting at their lowest percentile ranks over the last two years, which in turn, highlights how robust recent interest has been most recently, especially as flows are trending toward their two-year highs.

Both Developed And Emerging Market ETFs Are Seeing Strong Flows

Source: Bloomberg Finance, L.P., as of December 17, 2019. Data represents the percentile rank of the rolling one-month net flows of U.S.-listed emerging markets ETFs and developed markets ETFs, specifically targeting exposure to the Emerging and EAFE markets, respectively.

WHAT’S NEXT?

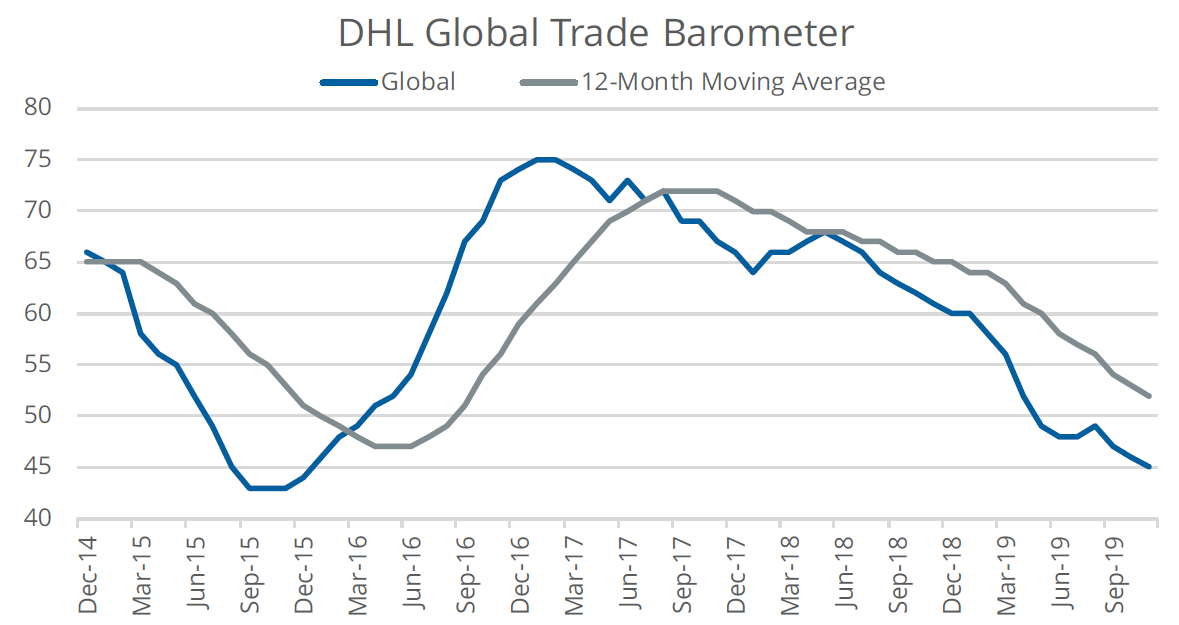

- A unique measure of global trade has been forecasting declines in overall production due to a slowing economy. The DHL Global Trade Barometer aggregates data from air and containerized ocean freights in seven countries, which accounts for more than 75 percent of world trade. The measure uses this import and export data for a number of intermediate and early-cycle commodities that serve as the basis for further industrial production. For example, the barometer incorporates items such as brand labels for clothes, bumpers for cars, or touch screens for mobile devices.

- At the end of November, the barometer fell to 45, pointing to a decline in world trade over the coming months, which is the lowest level since December 2015. While the recent FedEx earnings was discouraging and seemingly continuous, EM PMIs seen to have stabilized, which is a positive for future trade.

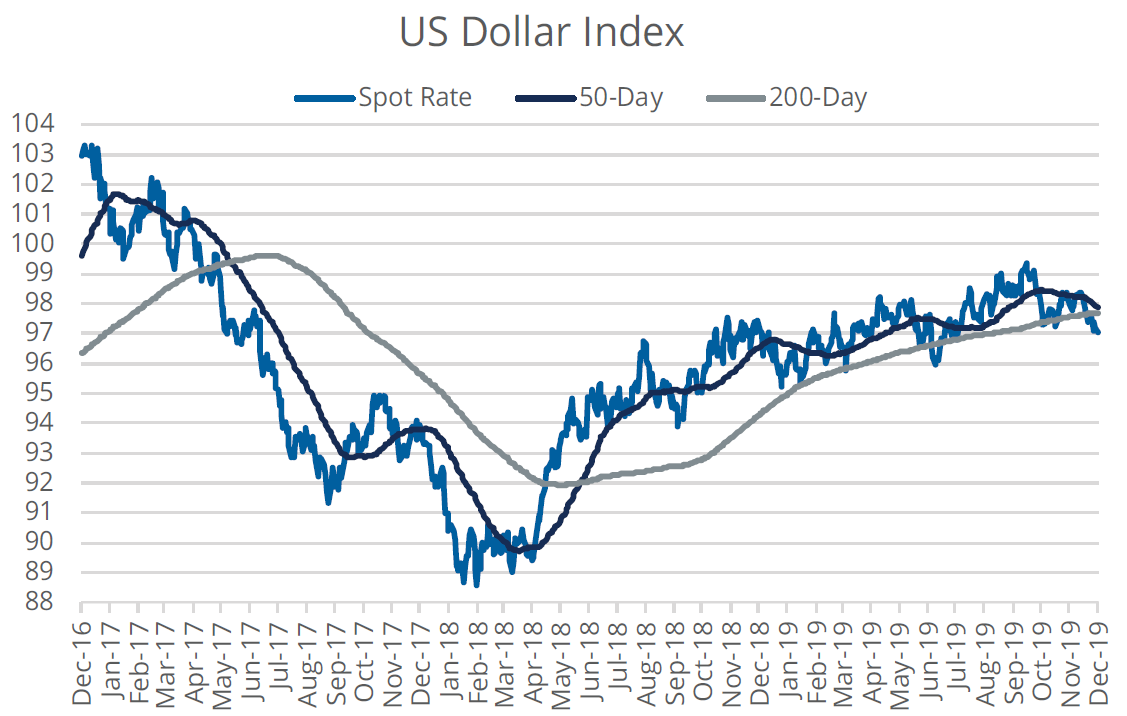

In addition to better news on the trade front, another macro positive for emerging markets would be a decline in the U.S. dollar, which has remained persistently strong relative to especially to those of emerging market countries.

Global Trade Has Trended Lower

Source: Bloomberg Finance, L.P., as of November 12, 2019. Growth represented by the Russell 1000 Growth Index and Value represented by the Russell 1000 Value Index. Past performance is not indicative of future returns. One cannot invest directly in an index.

IMPLEMENTATION IDEAS

- The Direxion MSCI Emerging Over Developed Markets ETF [RWED] would benefit should emerging markets outperform thanks to its overweight to emerging markets relative to developed markets.

- Investors interested in overweighting the MSCI EAFE IMI Index relative to the MSCI Emerging Markets IMI Index can look to the Direxion MSCI Developed Over Emerging Markets ETF [RWDE] as a solution.

DEFINITIONS

- MSCI Emerging Markets IMI Index: The MSCI Emerging Markets Investable Market Index (IMI) is a free float-adjusted market capitalization weighted index that is designed to represent large- and mid-capitalizations securities across 24 Emerging Markets countries.

- MSCI EAFE IMI: The MSCI EAFE Investable Market Index (IMI), is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and mid-capitalization companies across 21 developed market countries around the world, excluding the US and Canada.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 646-627-9665 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Relative Weight ETFs Risks – Investing involves risk including possible loss of principal. The Funds’ investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in or shorting securities or other investments. Investing in, and/or having exposure to, emerging markets instruments involves greater risks than more developed markets due to the potential for greater market volatility, lower trading volume, higher levels of inflation, political and economic instability, greater risk of market shutdown and more government limitations on foreign investments in emerging market countries than typically found in more developed markets. There is no guarantee that the returns on the Funds’ long or short positions will produce high, or even positive returns and the Funds could lose money if either or both of the Funds’ long and short positions produce negative returns. Please see the summary and full prospectuses for a more complete description of these and other risks of the Funds.

Distributor for Direxion Shares: Foreside Fund Services, LLC.