Yes, trade wars are a key risk that could negatively affect the U.S. economy, but it’s not the only thing, according to Mary Daly, president and chief executive of the Federal Reserve Bank of San Francisco. Other issues like slowing global growth and Brexit are keeping Daly up at night aside from trade wars.

“I don’t want us to get too focused on only trade when there are these other looming uncertainties that also need resolution,” she said.

One risk in particular that is a cause for concern is business sentiment. As a protracted trade war continues, this could stymie enthusiasm for businesses, causing economic data and sentiment to diverge.

“What really keeps me up at night is the data and the mood getting out of sync and, eventually, the possibility that the mood becomes the self-fulfilling prophecy of the data,” Daly told reporters on Monday at the Symposium on Asian Banking and Finance in Singapore.

“RWIU” ETF in Play

The Direxion FTSE International Over US ETF (NYSEArca: RWIU) gives investors the opportunity to capitalize on their hunch that international equities will outdo U.S. equities, especially if Daly’s risks to the U.S. economy end up materializing.

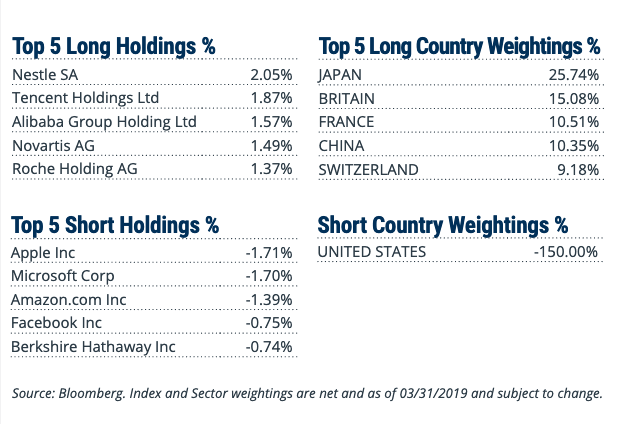

RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex US/Russell 1000 150/50 Net Spread Index. The FTSE All-World ex US/Russell 1000® 150/50 Net Spread Index (R1AWXUNC) measures the performance of a portfolio that has 150 percent long exposure to the FTSE All-World ex US Index and 50 percent short exposure to the Russell 1000® Index.

On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150 percent and the weight of the Short Component is equal to 50 percent of the Index value. In tracking the Index, the Fund seeks to provide a vehicle for investors looking to efficiently express an international over domestic investment view by overweighting exposure to the Long Component and shorting exposure to the Short Component.

U.S. Not Ready to Concede

Strength overseas could be challenged by the strong labor market in the U.S. The U.S. created 263,000 new jobs in April, which fed into a generational-low unemployment rate–the lowest in 49 years.

That increase in new jobs bested the 213,000 forecast of economists surveyed by MarketWatch.

On the flip side, for investors sensing continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

For more relative market trends, visit our Relative Value Channel.