As developed markets begin to reopen businesses en route to a sense of normalcy again, emerging markets are just starting to feel the effects of the coronavirus pandemic. As such, the apex of its economic effects could be just around the corner.

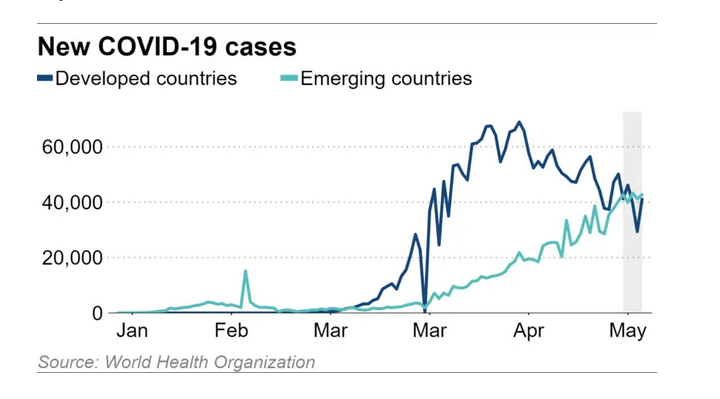

“While the U.S. and Europe move to reopen their economies, novel coronavirus cases are increasing rapidly in a number of big developing countries. New infections in developing countries have overtaken those in the rich world, with the number of new confirmed infections hitting 50,000 on Friday,” a Nikkei Asian Review article noted. “Developing countries are rushing to reopen their economies despite weak health care systems, sparking fears of an explosion of infections. Severe COVID-19 outbreaks in heavily indebted nations could drag on the world economy.”

“Nikkei has examined coronavirus cases using data from the World Health Organization,” the report added. “The number of new infections in developed nations has fallen by more than 40% in developed countries since the first half of April, but the virus continues to spread in emerging economies.”

Relatively Speaking: ETFs to Trade

Traders sensing more weakness in EM ahead can make a relative value exchange-traded fund (ETF) play in the Direxion MSCI Developed Over Emerging Markets ETF (NYSEArca: RWDE). RWDE provides a means to not only see developed markets perform well, but a way to access a convergence/catch-up in performance of DM relative to EM, a spread that has clearly widened over the past 6 months. The fund seeks investment results, before fees and expenses, that track the MSCI EAFE IMI – Emerging Markets IMI 150/50 Return Spread Index.

The index measures the performance of a portfolio that has 150% long exposure to the MSCI EAFE IMI Index (the “Long Component”) and 50% short exposure to the MSCI Emerging Markets IMI Index (the “Short Component”). On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150% and the weight of the Short Component is equal to 50% of the Index value. In tracking the Index, the Fund seeks to provide a vehicle for investors looking to efficiently express a developed over emerging investment view by overweighting exposure to the Long Component and shorting exposure to the Short Component.

On the opposite spectrum, as more EM governments do more to fortify their economies, a relative trade sets up nicely for the Direxion MSCI Emerging Over Developed Markets ETF (NYSEArca: RWED), which offers them the ability to benefit not only from emerging markets potentially performing well but from emerging markets outperforming developed markets.

RWED seeks investment results that track the MSCI Emerging Markets IMI – EAFE IMI 150/50 Return Spread Index. The Index measures the performance of a portfolio that has 150 percent long exposure to the MSCI Emerging Markets IMI Index and 50 percent short exposure to the MSCI EAFE IMI Index.

For more relative market trends, visit our Relative Value Channel.