The Direxion FTSE International Over US ETF (NYSEArca: RWIU) gives investors the opportunity to capitalize on their hunch that international equities will outdo U.S. equities, but given the latest trade talk progress, can this strategic play come into fruition?

U.S. President Donald Trump lobbed a grenade at the capital markets on Sunday with threats of more tariffs on China after ongoing media news hinted that a deal was close to getting done. Conversely, the latest reports have the President threatening a 25 increase for tariffs on $200 billion worth of Chinese goods come Friday.

The initial tariff rate was pegged at 10 percent, but the latest salvo of threats by President Trump come after trade talks are moving slower than expected. Much of the strength in U.S. equities has come as a result of a trade deal getting priced in, but this latest news could trigger a volatile week replete with sell-offs.

….of additional goods sent to us by China remain untaxed, but will be shortly, at a rate of 25%. The Tariffs paid to the USA have had little impact on product cost, mostly borne by China. The Trade Deal with China continues, but too slowly, as they attempt to renegotiate. No!

— Donald J. Trump (@realDonaldTrump) May 5, 2019

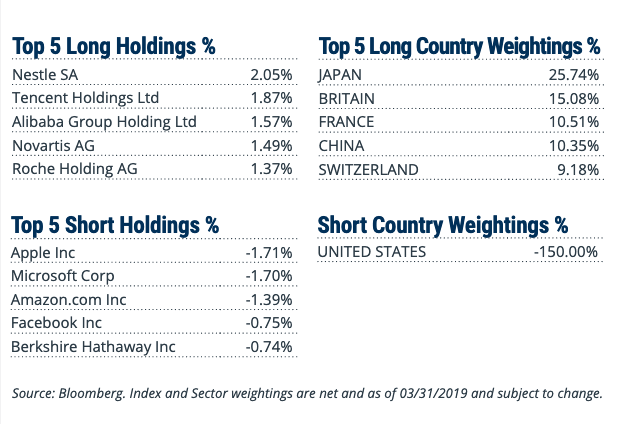

As for the fund, RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex US/Russell 1000 150/50 Net Spread Index. The FTSE All-World ex US/Russell 1000® 150/50 Net Spread Index (R1AWXUNC) measures the performance of a portfolio that has 150 percent long exposure to the FTSE All-World ex US Index and 50 percent short exposure to the Russell 1000® Index.

On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150 percent and the weight of the Short Component is equal to 50 percent of the Index value. In tracking the Index, the Fund seeks to provide a vehicle for investors looking to efficiently express an international over domestic investment view by overweighting exposure to the Long Component and shorting exposure to the Short Component.

U.S. Not Ready to Concede

Strength overseas could be challenged by the strong labor market in the U.S. The U.S. created 263,000 new jobs in April, which fed into a generational-low unemployment rate–the lowest in 49 years.

That increase in new jobs bested the 213,000 forecast of economists surveyed by MarketWatch.

“The bottom line is effectively unchanged,” said Jim Baird, chief investment officer at Plante Moran Financial Advisors. “Job creation remains solid, and should provide continued support for consumer spending sufficient to keep the economy on a solid growth path.

On the flip side, for investors sensing continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

For more relative market trends, visit our Relative Value Channel.