Source: Bloomberg Finance, L.P., as of February 12, 2019. Data represents U.S.-listed ETFs targeting broad-based exposure to Developed Markets and Emerging Markets, respectively.

What’s Next?

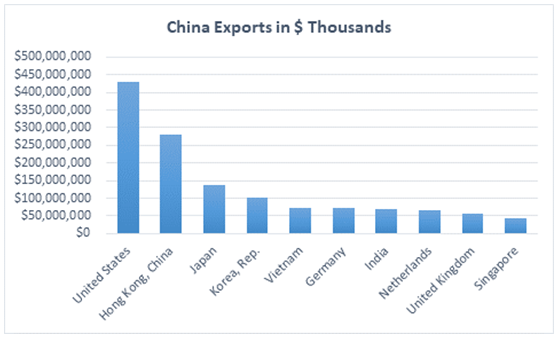

- The outcome of the U.S. – China trade deal represents a significant source of uncertainty for the direction of this pair in the near-term driven by the connectivity of trade between China and the rest of the world. In fact, developed markets index heavyweights like Japan and Germany represent China’s two largest developed markets trading partners outside of the U.S., which is its largest.

- However, YTD price action clearly suggests some optimism around a deal coming to fruition, or at least some positive developments before the proposed March 1st deadline. Outside of Brazil, China has been, by far, one of the best performing EM country year-to-date. China, as measured by the MSCI China Net Total Return Index (in USD), has gained over 12% as of the close yesterday.

China’s Top Ten Trading Partners Show Linkages Across Developed and Emerging Markets

Source: World Bank, as of February 12, 2019.

Implementation Ideas

For investors looking for the continued upside in emerging market assets, whether driven by a weakening USD or continued developments around trade, the Direxion MSCI Emerging Over Developed Markets ETF (RWED) offers them the ability to benefit not only from emerging markets potentially performing well, but from emerging markets outperforming developed markets.

Conversely, if investors believe that resolutions to the big issues impacting sentiment today are in motion, the Direxion MSCI Developed Over Emerging Markets ETF (RWDE) provides a means to not only see developed markets perform well, but a way to access a convergence/catch-up in performance of DM relative to EM, a spread that has clearly widened over the past 6 months.

Risks: Investing involves risk including possible loss of principal. The ETFs’ investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in or shorting securities or other investments. There is no guarantee that the returns on an ETF’s long or short positions will produce high, or even positive returns and the ETF could lose money if either or both of the ETF’s long and short positions produce negative returns. Please see the summary and full prospectuses for a more complete description of these and other risks of the ETFs.

Distributor: Foreside Fund Services, LLC