Economists at global investment firm Morgan Stanley said that a U.S. recession is not an unrealistic expectation, and the case for a bearish turn for the markets is a plausible one given a protracted U.S.-China trade war. Relatively speaking, this could put U.S. equities on watch for future weakness, giving exchange-traded fund (ETF) investors an opportunity to play U.S. versus international equities.

“For now, the path to the bear case of a U.S. recession is still narrow, but not unrealistic,” a team led by the firm’s chief U.S. economist, Ellen Zentner, told Morgan Stanley clients.

“If trade tensions escalate further, our economists see the direct impact of tariffs interacting with the indirect effects of tighter financial conditions and other spillovers, potentially leading consumers to retrench,” she wrote. “Corporates may start laying off workers and cutting capex as margins are hit further and uncertainty rises.”

The majority of the capital market is looking for an interest rate cut by the Federal Reserve to propel the major U.S. indexes, but a sluggish showing in second-quarter earnings could mean that U.S. equities could be overvalued. Would a less-than-stellar second-quarter earnings showing put international equities over U.S. equities?

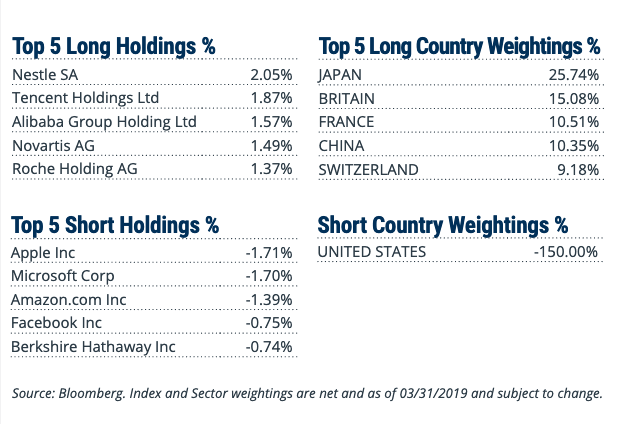

For investors looking to play the international equities over U.S. equities angle, the Direxion FTSE International Over US ETF (NYSEArca: RWIU) gives investors the opportunity to capitalize on this hunch. RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex US/Russell 1000 150/50 Net Spread Index. The FTSE All-World ex US/Russell 1000® 150/50 Net Spread Index (R1AWXUNC) measures the performance of a portfolio that has 150 percent long exposure to the FTSE All-World ex US Index and 50 percent short exposure to the Russell 1000® Index.

On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150 percent and the weight of the Short Component is equal to 50 percent of the Index value. In tracking the Index, the Fund seeks to provide a vehicle for investors looking to efficiently express an international over domestic investment view by overweighting exposure to the Long Component and shorting exposure to the Short Component.

It’s not all doom and gloom for U.S equities with some analysts noting that of all the companies that have reported second-quarter earnings thus far, 79 percent are beating estimates and even notched 4.1 percent in growth. As such, for investors sensing continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

For more relative market trends, visit our Relative Value Channel.