Although indexes only make up one-third of funds, passive investments will reach upwards of 50% by 2021

Passive fund investing is poised to overtake active fund management, according to Moody’s. The credit agency explains that it is seeing a growing trend of purchases of passive investments such as index funds, with the result being outflows from active funds.

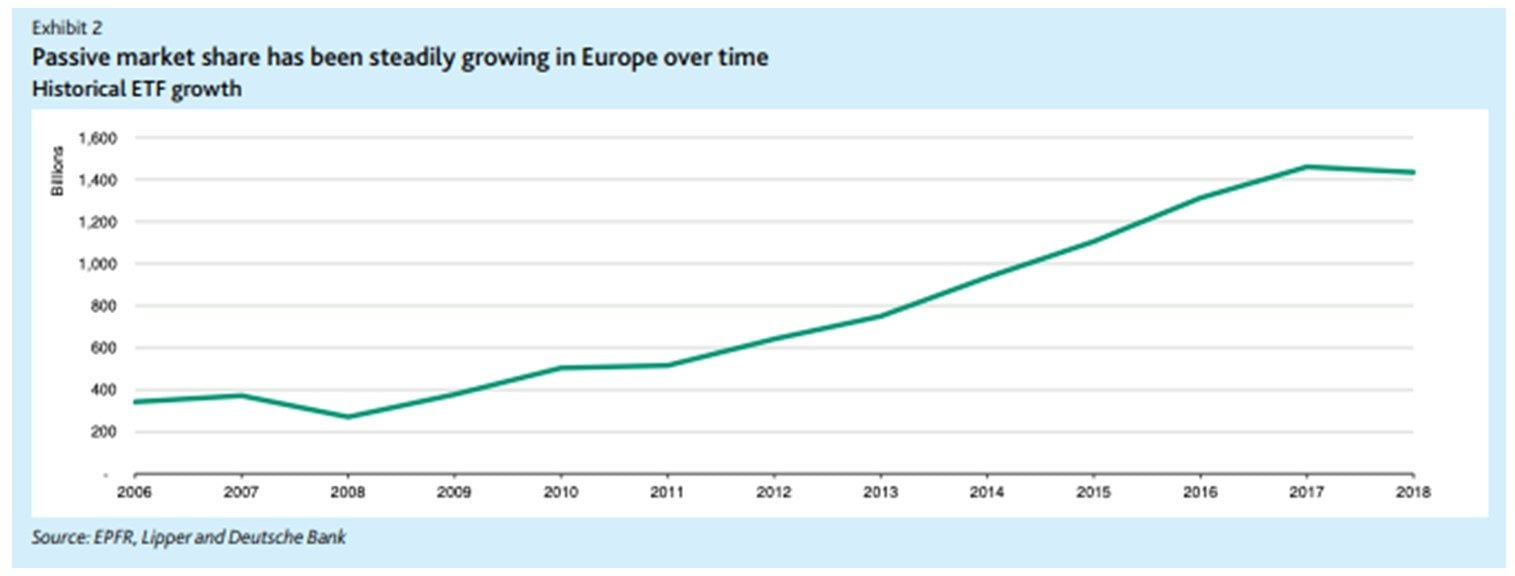

The current market environment observed last year has further contributed to this shift in passive investments strategy. Stock markets experienced its fair share of market volatility during 2018. Active mutual fund managers attempted to capture dips, but instead, often find themselves losing gains to index funds. This trend has been growing steadily since 2006.

As it stands now, the market for passive investments stands at 36.7% of the overall investment market. According to Moody’s, passive investments should reach up to 50% by 2021.

Mergers and acquisitions have also further contributed to passive investments and funds making gains against active funds. Passive exchange-traded funds, or ETFs, saw greater demand that is likely due to these trends.

It is expected, according to Moody’s, that passive investments growth- and ETF – will also experience greater demand across Europe, mainly due to increased regulation that will favor this investment strategy. The regulation in question is the European Union’s MiFID rules passed last year that clarified the fee structure of active funds and ruled that financial advisors could not be paid commissions by active funds.

For more market trends, visit ETF Trends.