Following the financial crisis in 2008, the recovery in the housing market saw a lot of buyers from China snatch up real estate in the United States for bottom-barrel prices. That no longer appears to be case as investors from China are starting to look elsewhere around the globe as a trade war with the U.S. gets protracted.

“The worsening trade relationship between China and the US may cause Chinese investors to shift their presence into other key markets,” property consultancy Knight Frank said in a report.

According to numbers provided by Juwai.com, China’s largest foreign property sales site, the amount of U.S. property sales relative to Chinese buyers saw a 4 percent drop from 2017 to 2018. Major cities in other countries like Australia, Japan, and the United Kingdom could see an influx of Chinese buyers.

“In the first quarter (of 2019), Chinese buyer enquiries on U.S. property were down 27.5% from a year earlier,” she said. “Meanwhile, they were up in Canada, the UK, Australia, and Japan, all of which are often considered alternative destinations to the United States.”

Protracted Trade War Could Affect Earnings

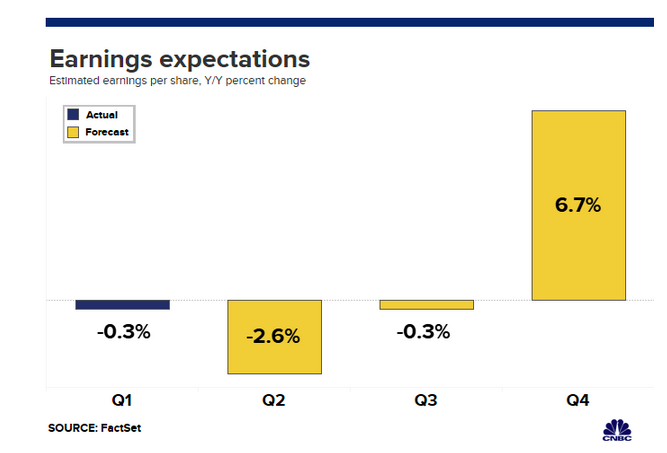

Analysts knew that the white-hot year for U.S. equities in 2018 would be difficult to duplicate in 2019 as corporate earnings would see a decline, but with fears of a global economic slowdown and trade wars, earnings could decelerate quicker than expected. In particular, an earnings slowdown in the second quarter of 2019 could very well flow over into the third quarter thanks to U.S.-China trade negotiations breaking down.

Data company FactSet is estimating that the third quarter outlook has changed from a gain of 0.2 percent to a slight decline of 0.3 percent as of late last week. The Q1 0.3 percent decline and Q2 drop of 2.6 percent would equate to the first three-quarter pullback in corporate profits in three years.

An earnings recession from Q4 2015 through Q2 2016 was the last time this three-peat of declines occurred. If analysts and corresponding data are correct, this could make for an interesting play in international equities gaining strength over U.S. equities.

The Direxion FTSE International Over US ETF (NYSEArca: RWIU) gives investors the opportunity to capitalize on their hunch that international equities will outdo U.S. equities, but given the latest trade talk progress, can this strategic play come into fruition?

RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex US/Russell 1000 150/50 Net Spread Index. The FTSE All-World ex US/Russell 1000® 150/50 Net Spread Index (R1AWXUNC) measures the performance of a portfolio that has 150 percent long exposure to the FTSE All-World ex US Index and 50 percent short exposure to the Russell 1000® Index.

On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150 percent and the weight of the Short Component is equal to 50 percent of the Index value. In tracking the Index, the Fund seeks to provide a vehicle for investors looking to efficiently express an international over domestic investment view by overweighting exposure to the Long Component and shorting exposure to the Short Component.

For more relative market trends, visit our Relative Value Channel.