Prior to a volatile climate in May that saw a U.S.-China trade deal hit a pothole, large cap equities were already outperforming small cap equities until the month of June, according to the July edition of Direxion Investments’ Relative Weight Spotlight. However, if the Federal Reserve’s hint of rate cuts to come are indeed due to a forthcoming global economic slowdown, investors may want to stay in large cap equities to blunt the impact.

“Large Caps, which have been winners relative to Small Caps throughout most of Q2, actually underperformed by 0.05% over the month of June,” the report noted. “While Small Cap outperformance speaks highly towards a more ‘risk-on’ sentiment in the markets, the relative outperformance was quite small. We view this ‘outperformance’ as more of a confirmation of market-breadth than a return to the type of Small Cap outperformance we saw in January and February.”

On the other hand, supporting academic research shows that stocks with a smaller market capitalization typically outperform their larger peers over the long term. However, small-cap investors will need to exercise patience, particularly since small cap equities have been lagging the past year.

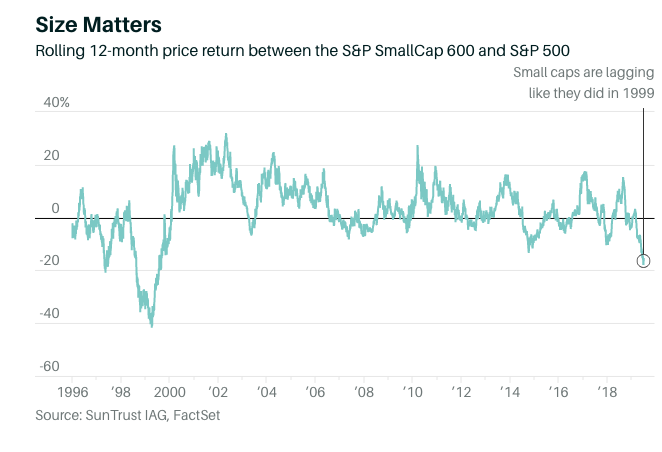

The S&P SmallCap 600 index is down 8.4% compared to a year ago, while the large-cap S&P 500 gained 9.4% during the same time. This small to large gap in performance is the largest since 1999, according to Keith Lerner, market strategist at SunTrust Advisory Services.

“It’s surprising to see how much small caps have underperformed large caps this year,” said Todd Rosenbluth, head of ETF & Mutual Fund Research at CFRA. “There are a lot of things that should have made an environment that is favorable for small caps, but they haven’t been helping.”

Not sure which side to play? Investors can capitalize on whether they think large cap equities will continue gaining strength in the interim or if small cap equities will maintain their long-term dominance.

Not sure which side to play? Investors can capitalize on whether they think large cap equities will continue gaining strength in the interim or if small cap equities will maintain their long-term dominance.

For investors looking for continued upside in large cap equities over small caps, the Direxion Russell Large Over Small Cap ETF (NYSEArca: RWLS) offers them the ability to benefit not only from large cap equities potentially performing well, but from their outperformance compared to their small cap brethren.

Conversely, if investors believe that small cap equities will outperform large cap equities, the Direxion Russell Small Over Large Cap ETF (NYSEArca: RWSL) provides a means to not only see small cap stocks perform well, but a way to capitalize on their outperformance versus their large cap brethren.

For more relative market trends, visit our Relative Value Channel.