The crux of first-quarter earnings will take place this week, which could sway sector-specific exchange-traded funds (ETFs) as industry movers and shakers release their reports. Direxion Investments published their latest Relative Weight Spotlight that could give ETF investors and traders some insight as to where the next best move might be to position themselves for the busiest week of earnings.

Two notable areas that could see continued strength are in large cap equities and defensive equities.

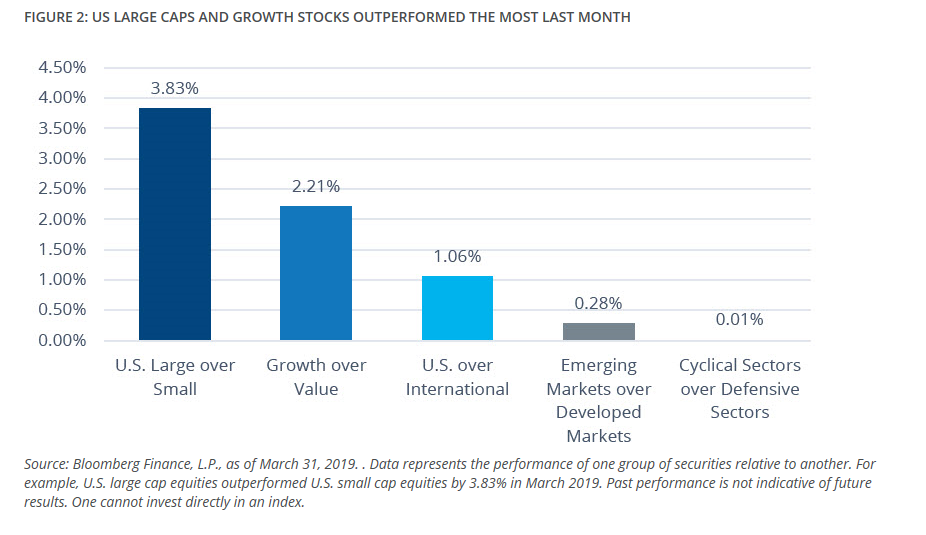

“From a performance perspective, the momentum behind cyclical sectors and small cap stocks are clearly starting to slow, especially relative to their defensive sector and large cap counterparts,” the report noted. “Through the first two months of the year, cyclical sectors outperformed defensive sectors by 5.56%. In March, defensives eked out a gain relative to cyclicals to the tune of 0.01%. Similarly, small caps outperformed large caps by 4.98% over January and February, but since March 1, this spread has narrowed, as large caps outperformed small caps by 3.83%.”

The movement of money has been in line with this trend towards large caps with the report noting that “the U.S. large cap and U.S. broad market categories have seen the largest absolute flows, with roughly $11.58B and $12.43B in net inflows, respectively.”

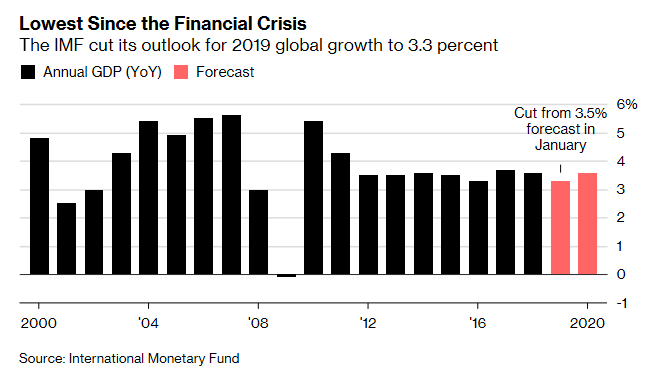

A main driver for this tilt to large caps and defensives could be investors feeling vexed over the concern on slowing global growth. Earlier this month, the international monetary fund (IMF) cut its global growth forecast to the lowest level since the financial crisis, citing the impact of tariffs and a weak outlook for most developed markets.

According to the IMF, the world economy will grow at a 3.3 percent pace, which is 0.2 percent lower versus the initial forecast in January.

“This is a delicate moment,” said IMF chief economist Gita Gopinath at a press briefing in Washington.

In addition, the global volume of trade in goods and services will increase 3.4 percent in 2019, which represents a drop from the 3.8 percent gain last year. The IMF, however, did mention that recent policy implementations like the U.S. Federal Reserve keeping interest rates steady are positive signs moving forward.

“Amid waning global growth momentum and limited policy space to combat downturns, avoiding policy missteps that could harm economic activity needs to be the main priority,” said the IMF.

While U.S. equities have been rebounding off the fourth-quarter sell-off in 2018, a key notable during earnings reports will be their guidance for the rest of the year. It will be interesting for investors to see how the reporting companies gauge their performance moving forward and whether this will translate to continued strength in large caps and defensives.

While U.S. equities have been rebounding off the fourth-quarter sell-off in 2018, a key notable during earnings reports will be their guidance for the rest of the year. It will be interesting for investors to see how the reporting companies gauge their performance moving forward and whether this will translate to continued strength in large caps and defensives.

Relative Weight ETFs to Trade

How can investors and traders capitalize on these trends?

For investors looking for continued upside in large cap equities over small caps, the Direxion Russell Large Over Small Cap ETF (NYSEArca: RWLS) offers them the ability to benefit not only from large cap equities potentially performing well, but from their outperformance compared to their small cap brethren.

Conversely, if investors believe that small cap equities will outperform large cap equities, the Direxion Russell Small Over Large Cap ETF (NYSEArca: RWSL) provides a means to not only see small cap stocks perform well, but a way to capitalize on their outperformance versus their large cap brethren.

For investors looking for continued upside in U.S. cyclical sectors over defensive sectors, the Direxion MSCI Cyclicals Over Defensives ETF (NYSEArca: RWCD) offers them the ability to benefit not only from cyclical sectors potentially performing well, but from their outperformance compared to defensive sectors.

Conversely, if investors believe that U.S. defensive sectors will outperform cyclical sectors, the Direxion MSCI Defensives Over Cyclicals ETF (NYSEArca: RWDC) provides a means to not only see defensive sectors perform well, but a way to capitalize on their outperformance compared to cyclical sectors.

For more relative market trends, visit our Relative Value Channel.