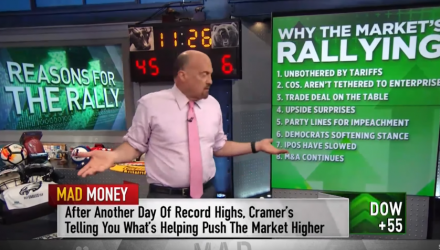

Whether it’s trade wars, an impeachment charge against U.S. President Donald Trump and other market concerns, CNBC’s “Mad Money” host Jim Cramer doesn’t foresee anything that will get in the way of more stock market gains—a potential opportunity to play the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI).

In particular, Cramer doesn’t foresee the big chain retailers in a world of hurt.

“The big guys in retail are doing just fine. Walmart, Target, Amazon, Costco simply haven’t felt the pain,” the “Mad Money” Cramer said.

Potential roadblocks like a U.S.-China “phase one” trade deal that has yet to materialize are also not obstructing equities for more gains. In a shortened trade week, it appears that optimism is fueling market movements.

“And money managers do not want to be caught on the wrong side of the trade going into Thanksgiving weekend,” Cramer said. “Instead of worrying about whether they are too long, they’re afraid of being too lean or worse, being short if Trump announced a big trade deal.”

With the 2020 election ahead, Cramer also doesn’t see impeachment proceedings derailing the market.

“We’ve known all along that these proceedings would only be stillborn — you’d need to get 20 Republicans in the Senate to vote against the President and so far not a single one has come out against him,” Cramer said. “Rightly or wrongly, that’s simply not on the table and the market senses the impotence of the Democratic efforts.”

As for the fund, RWUI features:

- Seeks investment results, before fees and expenses, that track the Russell 1000®/FTSE All-World ex-US 150/50 Net Spread Index (the “index”).

- The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in securities that comprise the Long Component of the index or shares of ETFs on the Long Component of the index.

- The index measures the performance of a portfolio that has 150% long exposure to the Russell 1000® Index (the “Long Component”) and 50% short exposure to the FTSE All-World ex-US Index (the “Short Component”).

Investors looking to play the other side can use the Direxion FTSE International Over US ETF (NYSEArca: RWIU) to capitalize on international equities will outdoing U.S. equities. RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex US/Russell 1000 150/50 Net Spread Index, which measures the performance of a portfolio that has 150 percent long exposure to the FTSE All-World ex US Index and 50 percent short exposure to the Russell 1000® Index.

For more market trends, visit ETF Trends.