A broad slowdown in demand, including China were the prime culprits in Broadcom reporting lower-than-expected earnings results recently. It dealt a blow to the semiconductor industry, but more importantly, could portend to broader weakness in the international economy as fears of a global economic slowdown could be showing up in the sector.

Broadcom results:

- Earnings: $5.21 per share, versus $5.16 per share as expected by analysts, according to Refinitiv.

- Revenue: $5.52 billion versus $5.68 billion expected by analysts, according to Refinitiv.

Additionally, the company lowered its guidance for its 2019 fiscal year and expects $22.50 billion in revenue as opposed to analysts polled by Refinitiv who were forecasting $24.31 billion in revenue for the 2019 fiscal year.

“We currently see a broad-based slowdown in the demand environment, which we believe is driven by continued geopolitical uncertainties, as well as the effects of export restrictions on one of our largest customers,” Broadcom CEO Hock Tan said in a statement. “As a result, our customers are actively reducing their inventory levels, and we are taking a conservative stance for the rest of the year.”

Other analysts like CNBC’s Jim Cramer opined on Broadcom’s disappointing results.

Truly depressing Broadcom call with a solemn Hock Tan.. Not good for the group, obviously. I thought he would have something up his sleeve….

— Jim Cramer (@jimcramer) June 14, 2019

Does this represent an opportunity for investors to buy into U.S. equities over international markets as signs of global growth are starting to reveal themselves?

The U.S. capital markets literally stumbled into 2019 after a slipping and sliding through a fourth quarter to forget–the Dow Jones Industrial Average fell 5.6 percent, while the S&P 500 was down 6.2 percent and the Nasdaq Composite declined 4 percent. Overall, 2018 marked the worst year for stocks since 2008 and only the second year the Dow and S&P 500 fell in the past decade.

Despite a number of roadblocks heading into 2019 after a rough fourth-quarter market showing to end 2018, the U.S. economy rebounded in the first quarter this year, beating analysts’ expectations of 2.5 percent growth with a 3.2 percent growth number.

The GDP figure represents the strongest rate of growth for the first quarter in four years and matches the 3.2 percent growth experienced a year ago.

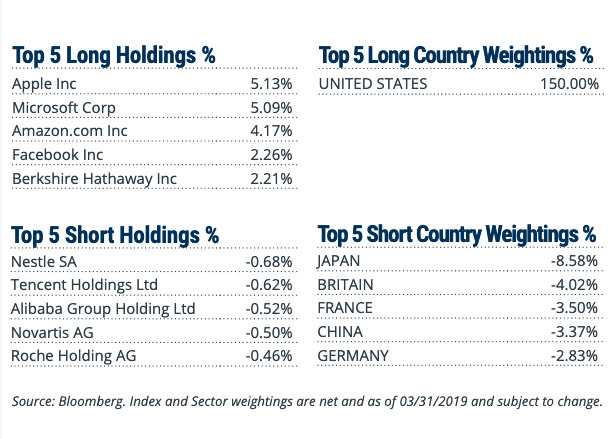

For investors looking for continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

For more market trends, visit ETF Trends.