May’s market volatility due to U.S.-China trade wars has been a progenitor of suffering in the emerging markets (EM) space. The distaste for EM was certainly evident, according to Direxion Investments’ “Relative Weight Spotlight” post on EM versus developed markets (DM).

However, this sets up a trading opportunity for investors to capitalize on EM weakness and slide into DM strength.

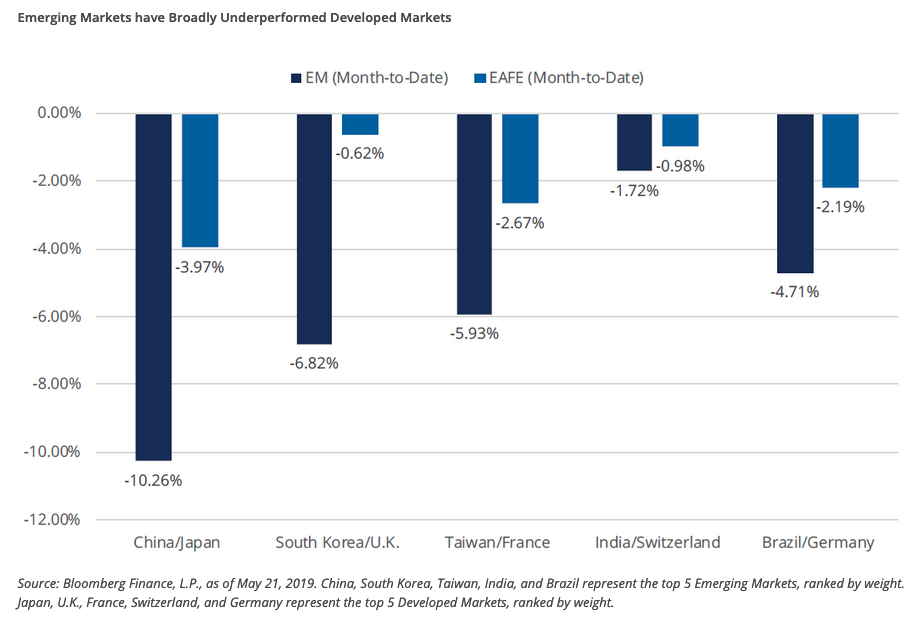

“On the back of a deteriorating macroeconomic backdrop, one that has been largely driven by trade and growth fears, emerging markets have been a stark underperformer relative to their developed market counterparts throughout the month of May,” the Direxion post noted. “In fact, not a single country in the top five emerging markets nations by weight has outperformed a developed market nation in the top five by weight. In both cases, the top five countries by weight make up over 67% of each respective basket.”

The U.S.-China trade war is certainly injecting a dose of distaste for certain markets and one in particular is opportunities overseas in the form of emerging markets. As U.S.-China trade deal negotiations began to break down, emerging markets took a gut shot, but while they might be reeling, they could stage a late-round comeback.

“Emerging markets are bearing the brunt of an escalating trade war between the world’s two largest economies and there is no certainty on when this ends,” wrote CNBC’s Spriha Srivastava. “Last week was the worst for emerging market currencies since the Turkish lira crisis of summer 2018. The Chinese yuan has lost nearly 3% of its value against the U.S. dollar since May 5 — the day President Donald Trump tweeted about new tariffs on the country.”

Global investment firm Goldman Sachs is saying “enough is enough” in the EM space with significant risks ahead as the U.S.-China trade spat continues to bring uncertainty to the capital markets.

“We have scaled back overweight exposure to EM (emerging market) currencies and EM debt until we gain clarity on the direction of travel for both U.S.-China trade relations and global growth, with the two being interconnected,” Goldman Sachs Asset Management (GSAM) said in a note.

2019 has thus far seen the reemergence of emerging markets (EM), but while investors are sifting through the plethora of opportunities the EM space has to offer, investors can play to the strength of the EM space over developed markets. Or, they can follow the lead of Goldman Sachs and capitalize on possible weakness in the EM space by putting their money on developed markets.

For investors looking for the continued upside in emerging market assets, whether driven by a weakening USD or continued developments around trade, the Direxion MSCI Emerging Over Developed Markets ETF (NYSEArca: RWED) offers them the ability to benefit not only from emerging markets potentially performing well, but from emerging markets outperforming developed markets.

Conversely, if investors believe that resolutions to the big issues impacting sentiment today are in motion, the Direxion MSCI Developed Over Emerging Markets ETF (NYSEArca: RWDE) provides a means to not only see developed markets perform well, but a way to access a convergence/catch-up in performance of DM relative to EM, a spread that has clearly widened over the past 6 months.

For more relative market trends, visit our Relative Value Channel.