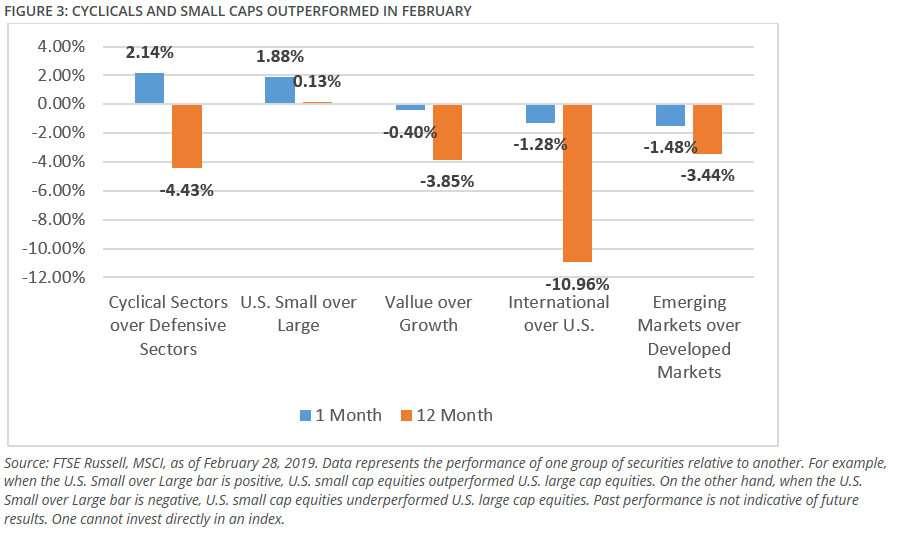

Despite last week’s declines, U.S. equities are off to a strong start with the Dow up 9 percent, the S&P 500 up 9.42 percent and the Nasdaq Composite 11.65 percent higher. As such, a positive risk appetite is returning to the capital markets, which is set the tone for small cap and cyclical equities during the month of February.

In its latest Relative Weight Outlook report, Direxion mentioned that “even in the face of slowing global economic growth and increased geopolitical uncertainty, equity-market volatility collapsed markedly as risk appetite increased.” February, in particular, saw cyclicals take the lead over defensive sectors while small caps outperformed their large cap brethren.

“Looking at the performance of relative weight strategies that offer amplified exposure of one market segment to another shows that the performance of U.S. small cap companies relative to U.S. large cap companies generated the best returns over the last month thanks to an environment that saw small outperform large by 1.81% with a return of 6.46%,” the report said.

“Looking at the performance of relative weight strategies that offer amplified exposure of one market segment to another shows that the performance of U.S. small cap companies relative to U.S. large cap companies generated the best returns over the last month thanks to an environment that saw small outperform large by 1.81% with a return of 6.46%,” the report said.

In the following video, David Rosenberg, chief strategist and economist at Gluskin Sheff, and Data Peterson, economist at Citi, join “Squawk Box” to discuss the latest data points such as retail sales and jobs, the overall economy, and Fed Chair Powell’s latest comments in his interview with 60 Minutes.

For investors looking for continued upside in U.S. cyclical sectors over defensive sectors, the Direxion MSCI Cyclicals Over Defensives ETF (NYSEArca: RWCD) offers them the ability to benefit not only from cyclical sectors potentially performing well, but from their outperformance compared to defensive sectors.

Conversely, if investors believe that U.S. defensive sectors will outperform cyclical sectors, the Direxion MSCI Defensives Over Cyclicals ETF (NYSEArca: RWDC) provides a means to not only see defensive sectors perform well, but a way to capitalize on their outperformance compared to cyclical sectors.

For more market trends, visit ETF Trends