The U.S. capital markets literally stumbled into 2019 after a slipping and sliding through a fourth quarter to forget–the Dow Jones Industrial Average fell 5.6 percent, while the S&P 500 was down 6.2 percent and the Nasdaq Composite declined 4 percent. Overall, 2018 marked the worst year for stocks since 2008 and only the second year the Dow and S&P 500 fell in the past decade.

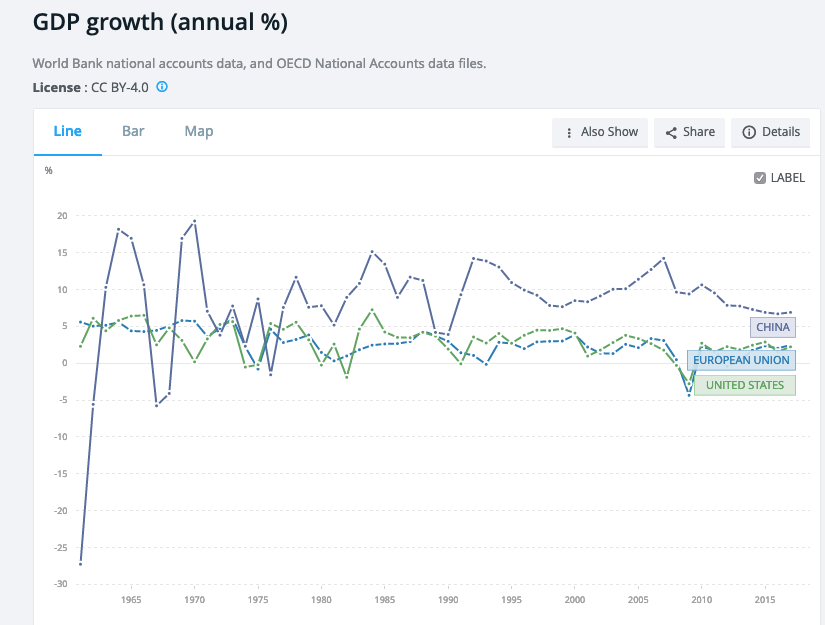

Despite a number of roadblocks heading into 2019 after a rough fourth-quarter market showing to end 2018, the U.S. economy rebounded in the first quarter this year, beating analysts’ expectations of 2.5 percent growth with a 3.2 percent growth number.

The GDP figure represents the strongest rate of growth for the first quarter in four years and matches the 3.2 percent growth experienced a year ago.

“While the (first quarter) boost from net trade and state and local government spending is unlikely to be repeated in [the second quarter], the main message is that private consumption and investment are slowing down only gradually,” said Brian Coulton, chief economist at Fitch Ratings, in a statement.

Related: New ETF Category for Traditional Investing Strategies

Exports helped to drive growth in the first quarter as a a decline in imports and higher inventory investment offset weaker consumer spending and business investment, according to the Commerce Department on Friday.

“The upside beat was helped by net trade (exports jumped while imports contracted sharply) and inventories which combined contributed almost 170 bps of the rise,” wrote Peter Boockvar, chief investment officer at Bleakley Advisory Group. “Personal spending though, the biggest component was up just 1.2%, two tenths more than expected as an increase in spending on services and nondurable goods offset a decline in spending on durable goods.”

This data certainly gave U.S. equities a boost last Friday–the S&P 500 rose 0.5 percent to 2,939.88 to reach an all-time closing high. In the meantime, the Nasdaq Composite ended the day up 0.3 percent at 8,146.40.

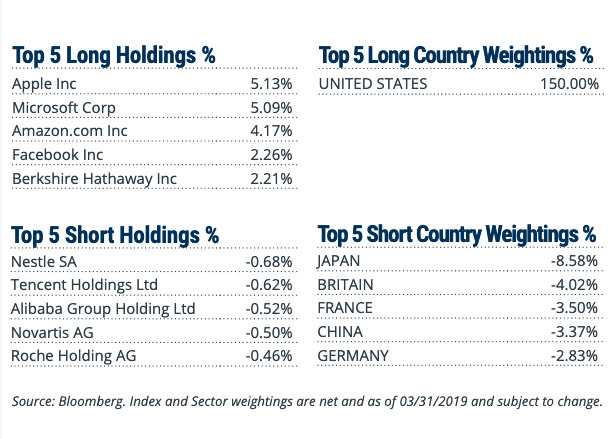

For investors looking for continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

The fund’s long positions include holdings that helped the S&P 500 and Nasdaq Composite reach highs last week like Apple and Microsoft, which just hit $1 trillion in market capitalization.

Short country positions include Japan, which saw a surprise drop in factory data the same time U.S. equities were doing better than expected in first-quarter earnings.

“Key risks to the outlook are U.S. protectionism and political instability in Europe. The former would hurt Japan’s exports that feed into global supply chains, as well as autos,” said Bloomberg economist Yuki Masujima.

Global Challenges Ahead?

The higher U.S. GDP comes global economic growth remains a primary concern. Earlier this month, the IMF cut its global growth forecast to the lowest level since the financial crisis, citing the impact of tariffs and a weak outlook for most developed markets.

According to the IMF, the world economy will grow at a 3.3 percent pace, which is 0.2 percent lower versus the initial forecast in January. Nonetheless, strength in leading markets like the U.S. with its healthy labor market are keeping global growth afloat.

Will the U.S. continue its upward trajectory in the second quarter and through the rest of 2019? Helping to boost the case for international equities is stiff competition from China.

A mix of Chinese stimulus measures have been providing the fodder for economic growth, such as lower taxes, no corporate tax breaks, monetary policy adjustments, and more market access for foreign companies to set up shop. All in all, Wall Street is looking at the Chinese government’s latest efforts as a plus for its economy, which makes it rife for investment.

For more market trends, visit ETF Trends.