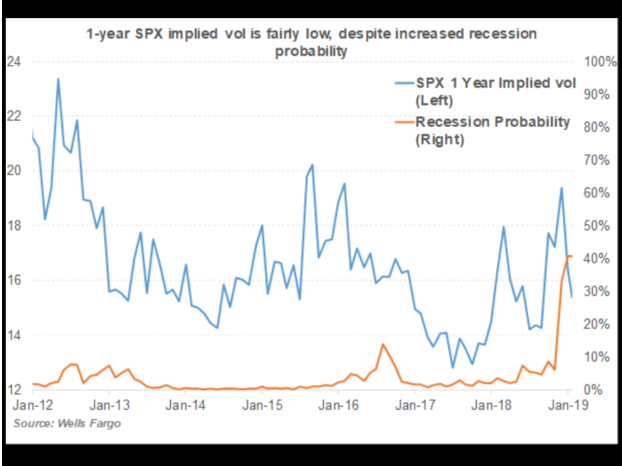

The concept is difficult to fathom given that market volatility is down, but according to analysts, this is where the red flag begins waving.

“Despite the increased recession probability, long-dated equity volatility is actually trading lower than in previous years,’’ Pravit Chintawongvanich, a Wells Fargo equity derivatives strategist, wrote in a note.

Related: Industrial ETFs Are Outperforming Among U.S. Sector Picks

This disconnect between volatility and recession probability hearkens back to the financial crisis in 2008.

“In 2007, 1-year vol traded at very low levels despite recession risk having increased rapidly in 2006,’’ Chintawongvanich wrote. “It was only when Bear Stearns started running into trouble in summer 2007 that 1-year vol rapidly repriced.’’

For more market trends, visit ETF Trends.