To start 2019, a positive risk appetite returned to the capital markets as U.S. equities bounced back from their fourth-quarter doldrums, but risk-off was back in May as the capital markets got a taste of the volatility they haven’t experienced in months. During this time, it was defensive sectors that became the flavor of the month as investors sought to safe havens to shield them from the volatility.

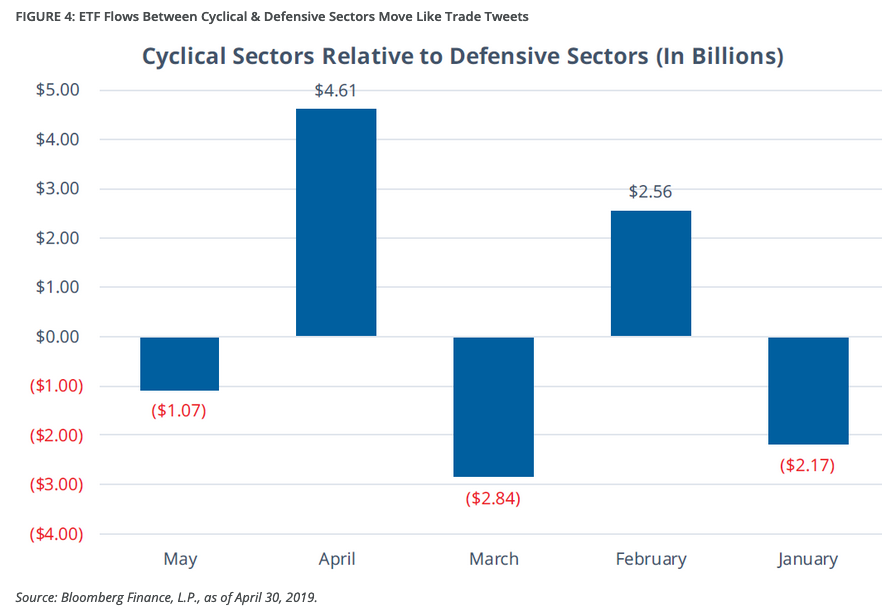

In its latest Relative Weight Outlook report, Direxion mentioned that “investors spent the month of May reducing exposure to both Cyclical and Defensive Sectors with $3.25 billion out of Cyclicals and $2.19 billion out of Defensives as ETF investors seemingly choose not to discriminate between either group. Notable, however, is the pace and frequency of the relative strength in flows between these market segments. Cyclical and Defensive sectors have alternated leadership in flows on a monthly basis throughout the entire calendar year. Figure 4 shows the month-over-month relative strength in flows between Cyclical and Defensive Sectors.”

Heading into June, the fears of a global economic slowdown continue to permeate the capital markets. Amid the wall of worry is, of course, the trade negotiations between the United States and China.

With a permanent trade deal already been priced into equities–May was highlighted by mass sell-offs after the U.S.-China trade deal that was supposed to happen went under.

“Cyclical sectors, which outperformed defensive sectors by 6.56% throughout the month of April, and had outperformed defensive sectors by 13.20% throughout the first four months of 2019, underperformed by -3.10% in May as a result of negative trade rhetoric, and a 10-Year U.S. Treasury Yield that fell from 2.405% to 2.164%,” the post added.

“This drubbing was broad based as five of the six cyclical sectors underperformed the market with the expectation of Communication Services outperforming. On the flip side, Real Estate and Utilities outperformed the broader market by over 500 basis points, and Consumer Staples names outperformed by nearly 400 basis points. The Defensive Sectors basket was not without its own laggard, as the Energy Sector struggled in May as oil fell over 11%.”

For investors looking for continued upside in U.S. cyclical sectors over defensive sectors, the Direxion MSCI Cyclicals Over Defensives ETF (NYSEArca: RWCD) offers them the ability to benefit not only from cyclical sectors potentially performing well, but from their outperformance compared to defensive sectors.

Conversely, if investors believe that U.S. defensive sectors will outperform cyclical sectors, the Direxion MSCI Defensives Over Cyclicals ETF (NYSEArca: RWDC) provides a means to not only see defensive sectors perform well, but a way to capitalize on their outperformance compared to cyclical sectors.

For more market trends, visit ETF Trends