By Direxion

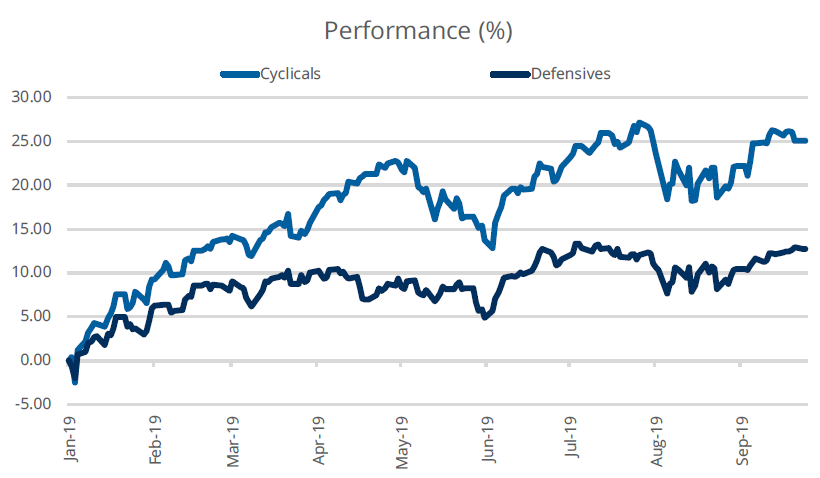

While cyclical sectors retain a considerable performance lead over defensive sectors on the year, their relative performance in August and September is showing signs of stalling, leading some investors to question whether the best days are behind for the group and that a rotation into defensives may prove to be more than simply a ripple.

While we acknowledge that cyclicals may get knocked around in the weeks until Q3 earnings season kickoffs, we caution against jumping into defensives even as their relative valuations are attractive as the balance sheet health of many defensive sectors remains in question.

Fear Factor

- Cyclicals are beating defensives by 11.61% through September 24 with April’s 6.56% of outperformance leading to a sizable portion of that delta. More recently, defensives have outperformed in the last two months as negative news around trade and fears of economic contraction permeate investor psyche.

- Year-to-date results highlight that cyclicals have been more volatile than their defensive peers thanks to market leaders like tech seeing robust results in up months, but sharp drawdowns in down months like May only leading to continued strength as markets absorb the news and go back to focusing on fundamentals and the macroeconomic environment.

Cyclicals Retain a Sizable Lead over Defensives

Source: MSCI, as of September 24, 2019. Cyclicals represented by the MSCI USA Cyclical Sectors Index and Defensives represented by the MSCI USA Defensive Sectors Index. One cannot invest directly in an index. Past performance is not indicative of future results.

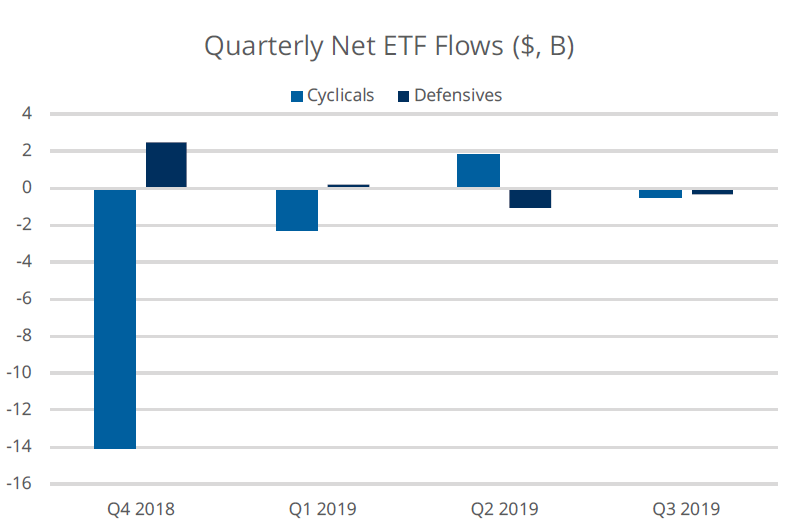

Follow the Money?

- Q4 2018’s massive outflows from cyclical sectors looks sharply out of place as flows this year have been considerably more modest both in absolute terms and relative to one another with defensives seeing $2.44 billion more net flows than cyclicals in Q1 and a $2.85 billion spread in favor of cyclicals in Q2 as positioning flip-flopped.

- In the most recent month, investors have moved away from both cyclicals and defensives (implying a broader retracement in overall equity exposure) with defensives seeing marginally less outflows even as cyclicals have a 0.91% lead over defensives. Year-to-date, a mere $268 million differentiates the two groups.

Flows into and out of Sector ETFs have Cooled Off

Source: Bloomberg Finance, L.P., as of October 1, 2019 to September 24, 2019. Data represents the quarterly net flows of U.S.-listed U.S. Cyclical Sector ETFs and U.S. Defensive Sector ETFs specifically targeting exposure to sectors defined by MSCI as Cyclicals and Defensives, respectively. Past performance is not indicative of future results.

What’s Next?

While investors have become accustomed to dealing with headlines from the trade war to conflicting economic data, they now have an impeachment inquiry of President Trump to digest. While there is historical precedent for impeachments on market performance, its forecasting ability may be nil this time around with the impeachment’s impact likely greatest in an indirect way on negotiating positions with the U.S.-China trade talks. Of course, investors are somewhat numb to calls for impeachment over the last for the last two and a half years.

- When it comes to the performance of risk-on and risk-off behavior in the stock market, historically October is thought of as one of the worst months for returns, but on average it is not; it has, however, seen some extremely difficult years like 1987 and 2008.

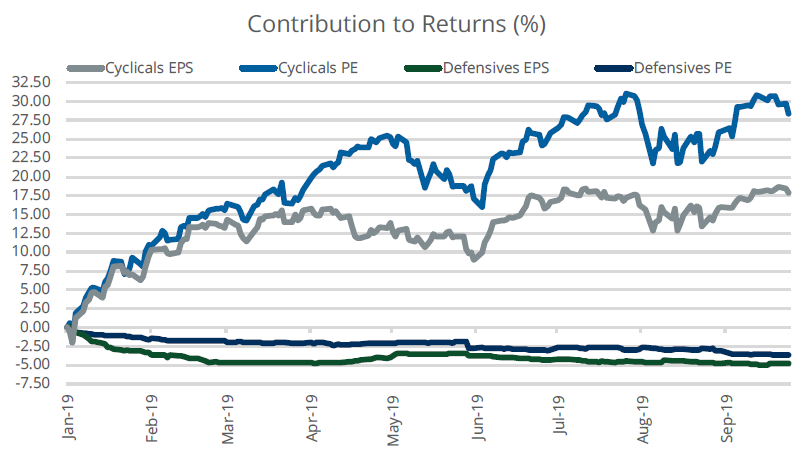

- This year’s setup may be considered questionable as the vast majority of gains have come from multiple expansion, not earnings growth. On a relative basis, cyclicals have seen their EPS decline less than defensives and their PE’s increase by a greater percentage. This level of multiple expansion without earnings growth does highlight why we have seen pullbacks for cyclicals be as sharp as they have during risk-off months.

- Q3 earnings begins on October 15 with analysts anticipating that cyclicals will experience -2.30% growth, which is better than the -7.68% projected for defensives. While both will likely come in better thanks to positive surprises, will we likely need to see an acceleration in earnings to see either group break out from their recent trading ranges in a considerable way.

Multiple Expansion has Driven Cyclical Outperformance

Source: Bloomberg Finance, L.P., MSCI, as of September 24, 2019. Cyclicals represented by the MSCI USA Cyclical Sectors Index and Defensives represented by the MSCI USA Defensive Sectors Index. One cannot invest directly in an index.

Implementation Ideas

- Having 150% exposure to cyclical sectors and -50% exposure to defensive sectors rebalanced on a monthly basis, the Direxion MSCI USA Cyclicals Over Defensives ETF [RWCD] is the only ETF that allows an investor to directly express an opinion on cyclicals relative to defensives.

- The Direxion MSCI USA Defensives Over Cyclicals ETF [RWDC] offers investors a portfolio construction tool that tilts toward firms that have historically had lower than market betas and away from those with higher betas giving the portfolio a more defensive posture.

DEFINITIONS

- MSCI USA Cyclical Sectors Index: The MSCI USA Cyclical Sectors Index is based on MSCI USA Index, its parent index and captures large and mid-cap segments of the US market. The index is designed to reflect the performance of the opportunity set of global cyclical companies across various GICS® sectors. All constituent securities from Consumer Discretionary, Financials, Industrials, Information Technology and Materials are included in the Index.

- MSCI USA Defensive Sectors Index: The MSCI USA Defensive Sectors Index is based on MSCI USA Index, its parent index and captures large and mid-cap segments of the US market. The index is designed to reflect the performance of the opportunity set of global defensive companies across various GICS® sectors. All constituent securities from Consumer Staples, Energy, Healthcare, Telecommunication Services and Utilities are included in the Index.

Direxion Relative Weight ETF Risks – Investing involves risk including possible loss of principal. The Funds’ investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in or shorting securities or other investments. Cyclical stocks tend to rise and fall with the business cycle and are typically companies that provide consumer discretionary good or services. Defensive stocks tend to remain stable during various phases of the business cycle due to constant demand for products. Defensive stocks generally include utility and consumer staples companies that produce goods bought out of necessity. There is no guarantee that the returns on the Funds’ long or short positions will produce high, or even positive returns and a Fund could lose money if either or both of the Fund’s long and short positions produce negative returns. Please see the summary and full prospectuses for a more complete description of these and other risks of the Funds.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 646-362-9458 or go to www.direxion.com. Read carefully before investing.

Distributor for Direxion Shares: Foreside Fund Services, LLC.