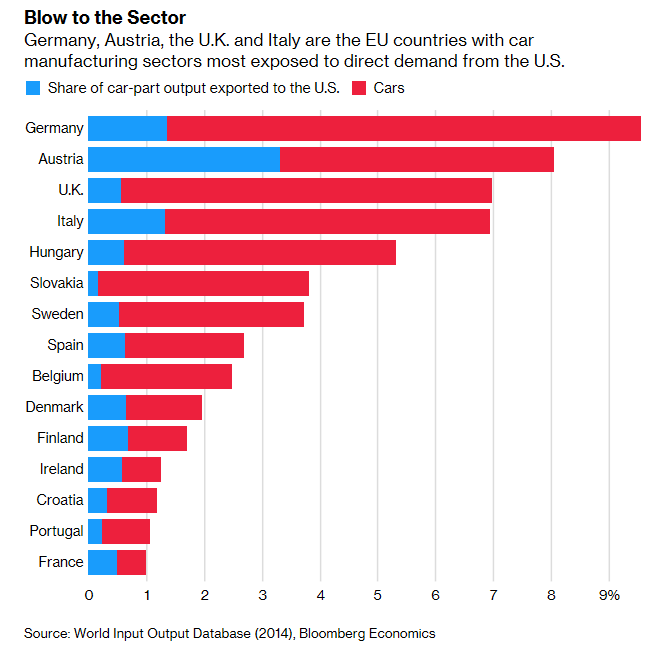

With negotiations with China underway to settle their trade differences, U.S. President Donald Trump is turning his attention to Europe as he’s threatening to impose car tariffs on the EU–notably Germany, Austria, the U.K. and Italy. The EU, in turn, would counteract with tariffs on companies like Caterpillar (CAT), which could affect various ETFs with holdings of the construction equipment manufacturer.

Last month, the EU said it would impose $22.7 billion of tariffs on U.S. products if Trump follows through on imposing duties on European automotive goods the same way he imposed tariffs on tax foreign steel and aluminum last year. The EU retaliated with levies on U.S. products like motorcycles, jeans and bourbon whiskey.

“Should there be tariffs on car and car parts, which we don’t want, we have started internally to prepare a list of re-balancing measures,” EU Trade Commissioner Cecilia Malmstrom told reporters on Friday in Bucharest after a meeting of the bloc’s commerce ministers. “There is full support to do this.”

Just last month, Caterpillar revealed one of its worst quarterly earnings in years, falling below Wall Street forecasts. The company said sales in its Asia/Pacific unit were 4% lower year-over-year “due to lower demand in China,” CNN reports.

According to Bespoke Investment Group, it was Caterpillar’s worst earnings miss in 10 years. Furthermore, CAT warned that its earnings outlook for 2019 could be lower than Wall Street forecasts.

ETF investors and traders should be wary of EU tariffs on Caterpillar that could also affect the funds with the heaviest weightings of CAT.

ETFs with Caterpillar exposure (courtesy of ETFdb.com):

|

Ticker

|

ETF

|

ETFdb.com Category

|

Expense Ratio

|

Weighting

|

|---|---|---|---|---|

| DIA | SPDR Dow Jones Industrial Average ETF | Large Cap Growth Equities | 0.17% | 3.64% |

| XLI | Industrial Select Sector SPDR Fund | Industrials Equities | 0.13% | 3.60% |

| EDOW | First Trust Dow 30 Equal Weight ETF | Large Cap Blend Equities | 0.50% | 3.45% |

| DJD | Invesco Dow Jones Industrial Average Dividend ETF | Large Cap Blend Equities | 0.07% | 3.27% |

| FIDU | Fidelity MSCI Industrials Index ETF | Industrials Equities | 0.08% | 2.88% |

For investors looking for continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

Conversely, if investors believe that international markets will outperform U.S. domestic markets, the Direxion FTSE International Over US ETF (NYSEArca: RWIU) provides a means to not only see international markets perform well, but a way to capitalize on their outperformance compared to the U.S. markets.

For more market trends, visit ETF Trends.