This week, the VettaFi Voices gather around the water cooler and talk smart beta and equal weight ETFs. With the Invesco S&P 500® Equal Weight ETF (RSP) recently seeing its 20th birthday, how can investors use smart beta ETFs to their advantage? What is their outlook for the rest of the year, and what types of equal weight ETFs are available?

Todd Rosenbluth, head of ETF research: I raised a glass to RSP turning 20 earlier in the week and talked about how the “buy low and sell high” approach to investing is the ideal scenario for many advisors. An equally weighted approach makes sense for those who don’t have a perfect crystal ball about what large-cap stocks will lead the market higher in any given year. But RSP was also the first smart beta ETF, a phrase few people like until they realize that is really how active management has worked for decades in a lower-cost, index-based approach. We have ETFs that are constructed based on quality, like the iShares MSCI USA Quality Factor ETF (QUAL) and the Invesco S&P 500® Quality ETF (SPHQ); valuation like the Alpha Architect U.S. Quantitative Value ETF (QVAL) and the Invesco S&P 500® Pure Value ETF (RPV); and momentum like the JPMorgan U.S. Momentum Factor ETF (JMOM) and the First Trust Dorsey Wright Focus 5 ETF (FV) based on the origination of RSP.

Now, of course, equally weighting does not always work, as our VettaFi colleagues covered this week. Mega-caps have been leading the market with Apple (AAPL), Microsoft (MSFT), Meta (META), etc., bouncing back in a return to large-cap growth companies as the darlings of the market. But who knows if this can continue and, if not, if more moderately sized companies like CBOE Global Markets, Eli Lilly (LLY), and McCormick (MKC), which were recent top 10 positions (at 0.23% of assets or higher) for RSP can lead the market.

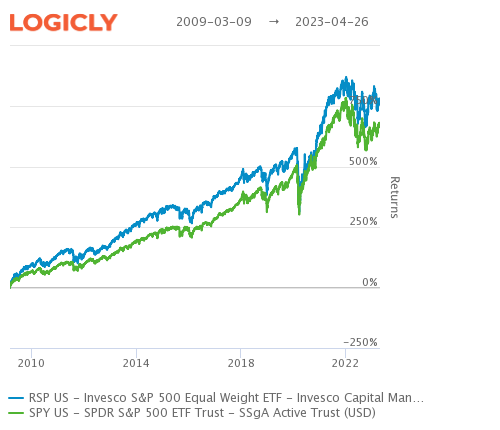

Dave Nadig, financial futurist: So, RSP was an absolutely incredible tool for a decade. From the March 9, 2009 equity bottom following the global financial crisis, we used to talk about it being an ABMC market — Anything But Market Cap. Right up until the pandemic sell-off, RSP was a long-term winner:

Rosenbluth: Great use of the newly acquired LOGICLY data, Dave.

Jeremie Capron, director of research of ROBO Global Indexes, a VettaFi business: We use a modified equal weighting to expose best-in-class robotics and automation. We see many benefits, including a fair representation of small- and mid-cap companies, which often deliver superior growth and takeover opportunities compared with large caps.

Avoiding concentration risk is an important part of our methodology. We believe the power of periodic rebalancing in terms of managing risk and taking advantage of short-term stock fluctuations.

Nadig: RSP’s very existence was a big part of why this conversation was even possible. I remember countless discussions with advisors where they were literally just trying to understand why they would want to own the “momentum” effects of the market-cap weighting methodology. But that story really reversed at the beginning of the pandemic:

So how should investors think about Smart Beta — using RSP as perhaps the simplest of the ABMC theme? Regimes. No smart beta product will outperform in every market environment (and if someone sells you one claiming absolute all-weather outperformance, I’ve got a bridge to sell you). The regime of the pandemic has been narrow markets, where well-capitalized dominant brands could capitalize on pandemic-related opportunities, and smaller firms were at least seen as struggling.

If you believed we were in a “rising tides” market, where news begets volatility and earnings beget investment, then equal weighting can make a lot of sense.

Right now, what’s fascinating to me is how funds like QUAL are outperforming (and indeed, they are this year). It comes down almost exclusively to a handful of stock selections: owning more META has been the key driver in most successful strategies this year.

Rosenbluth: I do not need a bridge right now, Dave, but it’s lunchtime for me in NY, so I’ll happily buy something sweet for dessert if you are selling. Anyway, QUAL is a good example of the fact that not all smart beta ETFs are the same. META is about 4% of the fund assets based on LOGICLY data, so when it is working out, it is a big boost, but more moderately sized companies like Estee Lauder (EL) are much smaller weightings. As you know, equal weight, or using the size factor, differs from the quality factor.

We also see equal weighting often used with thematic and industry ETFs. The Global Robotics & Automation Index ETF (ROBO), which now tracks an index part of the VettaFi family, and iShares Robotics and Artificial Intelligence Multisector ETF (IRBO) take such an approach, while one of their peers, the Global X Robotics & Artificial Intelligence ETF (BOTZ) has position sizes as large as 10%. Meanwhile, biotech ETF XBI, the SPDR S&P Biotech ETF (XBI), is equally weighted, but peer the iShares Biotechnology ETF (IBB) has a market cap-driven approach.

For those that like the approach to equal-weighting ETFs like the Direxion NASDAQ-100 Equal Weighted Index Shares ETF (QQQE) and the ALPS Sector Dividend Dogs ETF (SDOG) might be worth considering. They have a different approach, or focus on a different benchmark, than RSP but the concept is the same. Diversification is queen in the ETF world.

Roxanna Islam, associate director of research: To expand on what Todd said about thematic and industry ETFs, market-cap weighting is also very common in thematic ETFs, but sometimes I have mixed feelings. It can be good when you’re trying to represent the theme by its largest constituents and diversify away the risk from new entrants (which may be volatile or even short-lived companies). But for many themes, there just aren’t many pure-play companies, so they look similar with large weights toward META, AAPL, Google (GOOGL), etc.

And on the other hand, your thematic exposure could be intended as a high-risk/high-reward allocation, which means equal weight would be useful in spreading that exposure out to small caps. So there’s not really a correct answer, but it’s definitely something to consider when you’re looking at these ETFs.

For sector ETFs, it’s a similar story. Many may not be aware that a market-cap-weighted sector communications ETF like the Communications Services Select Sector SPDR Fund (XLC) currently has almost half its weight (47.1%) in Meta and Alphabet. Some investors might want that, but some investors might think that’s too much. I always talk about how it’s important to know what’s in your ETF — and that’s not just what holdings it has but also what weight they carry.

Rosenbluth: Agree on sector ETFs. Some sectors, like communication services and technology, are much more concentrated than others, like industrial and utilities, where there is less benefit from an equal-weighted approach. So taking an equally weighted approach does not make sense across the board.

Circling back to RSP, the launch 20 years ago was a key milestone for the ETF industry because it took index investing out of the market-cap-only world and set the stage for so many alternatively weighted strategies.

Charts provided by LOGICLY, which is a wholly-owned subsidiary of VettaFi.

VettaFi LLC (“VettaFi”) is the index provider for ROBO, for which it receives an index licensing fee. However, ROBO is not issued, sponsored, endorsed or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing or trading of ROBO.

For more news, information, and analysis, visit the Portfolio Strategies Channel.